- 📊 Ola Electric Q1 FY26 – Why Ola share price jumped?

- JK paper, west coast, Emami paper stocks rallied now?

- Why Is Dubai Importing So Much Natural Graphite?

- Impact of Anti-Dumping Duties on Methyl Acetoacetate on Laxmi Organic Industries’ PnL

- Bajaj Finance Q4 FY25 Earnings Review: Growth, Risks & What’s Next

📊 Ola Electric Q1 FY26 – Why Ola share price jumped?

Ola electric Share price sudden Jump after Q1 FY26 result – Breaking is this a…

JK paper, west coast, Emami paper stocks rallied now?

The Contrarian Case for Paper Stocks This is JK paper profits are continuously in downfall…

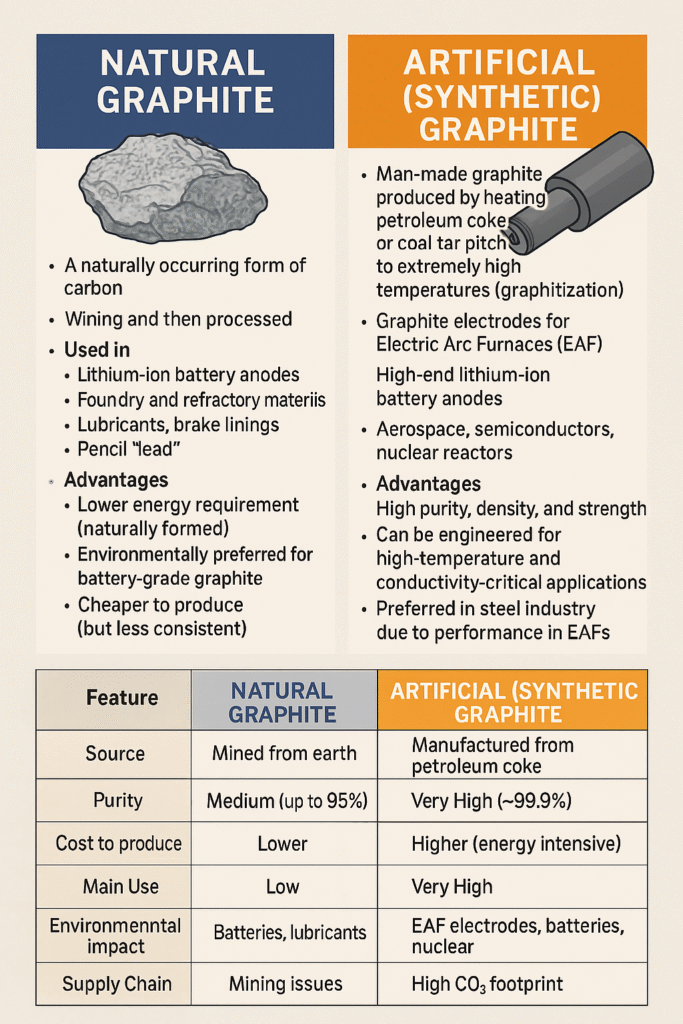

Why Is Dubai Importing So Much Natural Graphite?

Why Is Dubai a Desert City Importing So Much Natural Graphite? (2025 Analysis) Dubai has…

Impact of Anti-Dumping Duties on Methyl Acetoacetate on Laxmi Organic Industries’ PnL

Key elements impacting anti dumping duty Laxmi Organic Key Points: Laxmi Organic Industries is a…

Bajaj Finance Q4 FY25 Earnings Review: Growth, Risks & What’s Next

🔍 Bajaj Finance Q4 FY25 Analysis: Can India’s Fintech Giant Regain Its Profit Mojo? What…

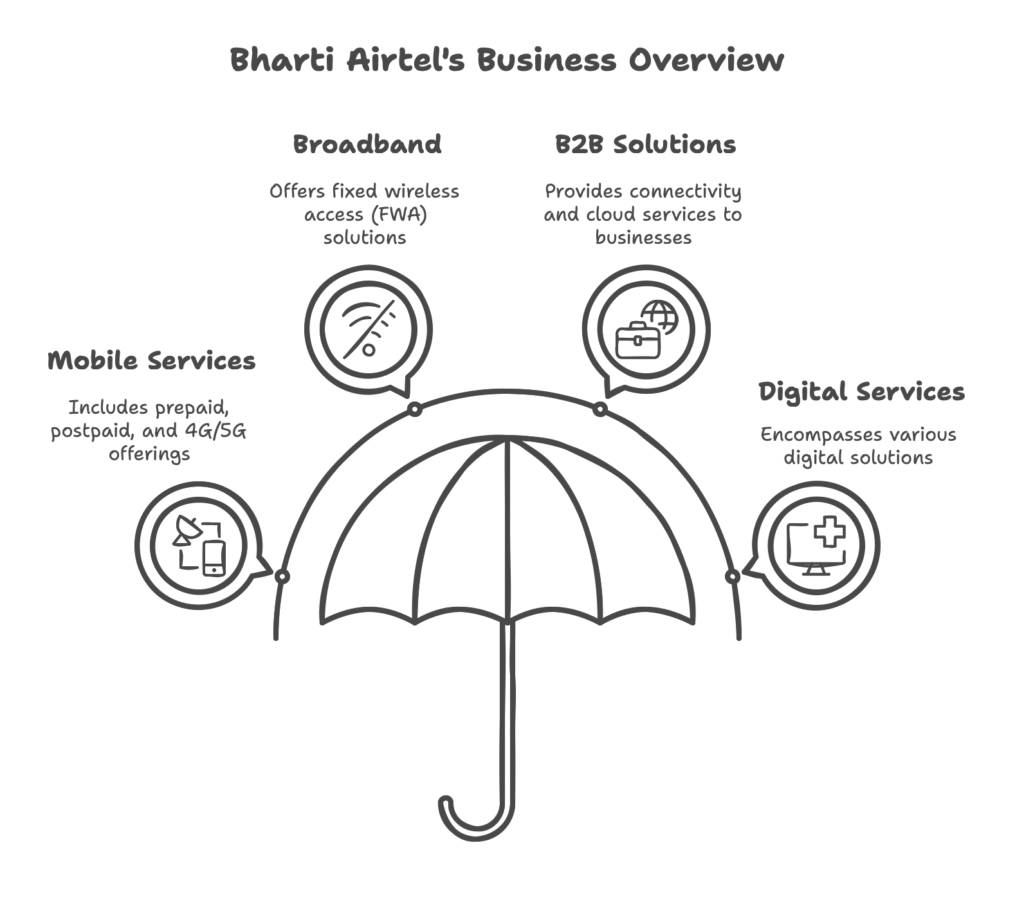

Bharti Airtel share Q4 FY25 Result – Unleashing Growth Potential

How Bharti Airtel share price is beating the trend and keep breaking the 52W high?…

Connecting the dots is our theme for finance stories

Core Goals: To educate traders and investors to look beyond market fear, chaos, and headlines, and develop the skill of “connecting the dots”—turning crises into opportunities by identifying hidden trends, behavioral patterns, and sectoral shifts.

Identify the Narrative:

Position “Connecting the Dots” as a timeless lens to approach investing—making it relatable, visual, and practical.

Shift Perspective:

Reframe how people view market downturns—from panic events to data-rich opportunities.

Introduce Strategic Thinking:

Show how events like COVID, wars, frauds (e.g., Hindenburg-Adani), and global shocks are not dead ends, but entry points for smart investing.

Build Trader Psychology:

Contrast the mindset of a reactive trader vs. a proactive digger, encouraging deeper research, patience, and pattern recognition.

Decode Real-World Events:

Break down historic examples where major market fears created multi-bagger opportunities for those who stayed informed and observant.