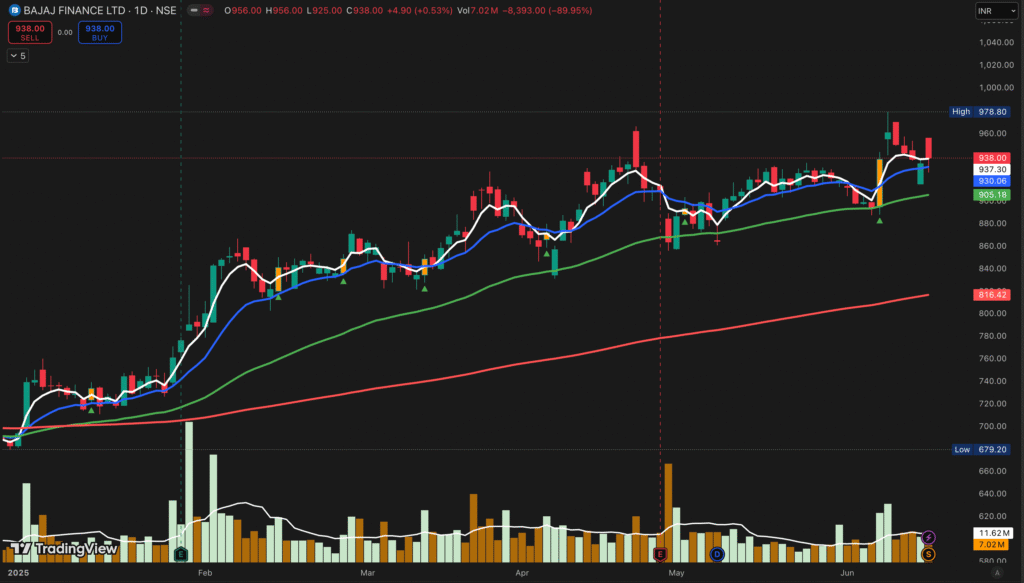

Blue chip Bajaj finance Ltd will issue1:2 Bonus shares on Monday, 16 Jun 2025 at pre issue price Rs. 9296

Bajaj finance Ltd, record date is fixed for Bonus Share &stock split on Monday, 16 Jun 2025.

“What is a Bonus Issue?

A bonus issue is when a company rewards its shareholders by giving them additional free shares based on their existing holdings. It’s like a “thank you” gift from the company—instead of cash, you get extra shares.

Example: ABC Company (1:1 Bonus Issue)

Before Bonus: You own 100 shares of ABC at ₹1,000 per share (Total Value = ₹1,00,000).

After Bonus (1:1): You get 100 extra shares (now 200 shares), but the price adjusts to ₹500 per share (₹1,00,000 ÷ 200).

Your Wealth? Same! (200 × ₹500 = ₹1,00,000).”

So when you will be eligible to get the bonus share of Bajaj finance Ltd ?

Since the Indian stock market follows the T+1 settlement system, investors must purchase the stock of Bajaj finance Ltd at least one working day prior for their names to appear on the list of eligible shareholders. Those who would purchase stock on Monday, 16 Jun 2025 will not be eligible to receive bonus shares and stock split benefits.

How many share you would get?

According to the 4: 1 stock bonus, shareholders of Bajaj finance Ltd who hold one equity share of face value of Rs 2 each will end up owning 5 equity shares of face value of Rs 2 each. So what will happen to current shareholders? A Bajaj finance Ltd shareholder who already owned 10 shares of the company as on the record date Monday, 16 Jun 2025 would get an additional 40 shares after the bonus issue in the ratio of 4: 1, and will subsequently have a total of 50 shares of the company. Those buying shares on Monday, 16 Jun 2025 will not be eligible for the bonus shares.

According to the 1:2 stock split, shareholders of Bajaj Finance who hold one equity share of face value of ₹2 each will end up owning two equity shares of face value of ₹1 each. Which means your number of share you hole will become double. So 50 share post bonus will become 100 shares.

Bajaj finance a wealth compounder for its share holders

Bajaj Finance has been a remarkable wealth creator, multiplying shareholder returns through a powerful combination of:

- Consistent Dividend Payouts (Rewarding shareholders with cash)

- Bonus Issues (Expanding ownership without extra cost)

- Stock Splits (Improving liquidity & affordability)

- Explosive Business Growth (Driving stock price appreciation)

Bajaj Finance has proven itself as a wealth-compounding machine by:

- Growing business (Expanding customer base & profits)

- Sharing rewards (Dividends + Bonus + Splits)

- Creating long-term value (Stock price appreciation)

For investors with patience, Bajaj Finance remains a top-tier compounding bet!

Pingback: Bonus Share and Stock (share) split - what is the differences and impact ? - onedailysnap.com