Evaluation of Camlin Fine Sciences Limited Q4 FY ’25 Earnings based on Conference Call

How Camlin fine science chart looks like?

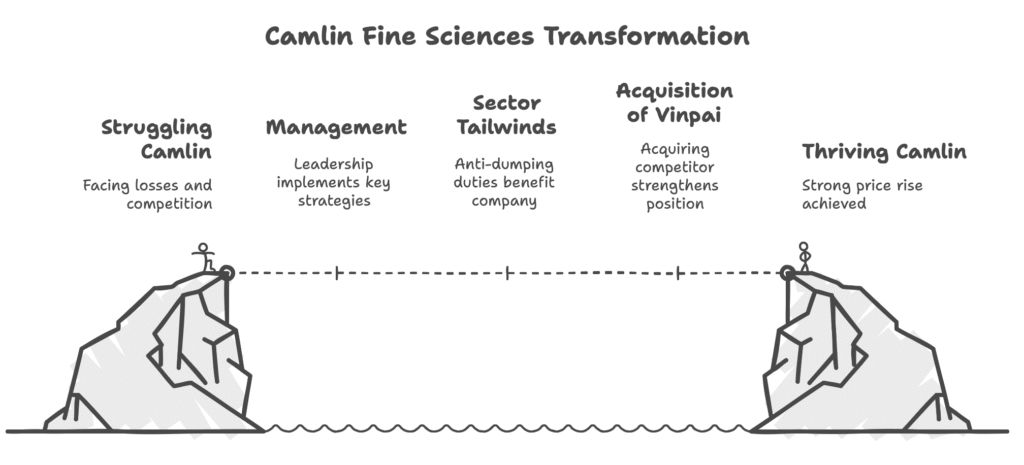

On 25th Feb 2025, Camfin announce the acquisition of Vinpai the strategic competitior in Europe and that day price was hovering around 150-160 and today price 17 Jun 2025, the price stand at Rs 318 as of yesterday closing. The intresting journey and con call summary.

The key factors based on the Q4 FY ’25 earnings conference call transcript for Camlin Fine Sciences Limited, presented in a table format followed by a summary

Management Con-call Summary:

Camlin Fine Sciences demonstrates resilience in a challenging global environment, with a 15% YoY revenue growth in core operations (INR 1,666 crores) and a 12.5% EBITDA margin (INR 208 crores). The vanillin segment is a key growth driver, benefiting from anti-dumping duties in the U.S. and proposed duties in Europe, with capacity utilization expected to reach 100% in 2 years. The blends business, bolstered by the Vitafor acquisition and potential Vinpai deal, shows strong growth (17-18% YoY, targeting 20% CAGR). Strategic exits from unviable European and Chinese units reduce cash burn, and debt reduction (from INR 564 crores to INR 492 crores) strengthens the balance sheet. However, pricing pressures, tariff uncertainties, and slow vanillin ramp-up due to destocking pose challenges.

The turn around story of Camlin fin sciences has fundamental changes company’s management has taken and resulted in the strong price rise in quick period. Stoping loss making unit to acquisition of Vinpai a strong player in the competition make the story worth tracking the company for other update.

| Factor | Observations from Concall | Critical Analysis |

|---|---|---|

| 1. Revenue Visibility / Order Book | Revenue grew 15% YoY; vanillin ramping; 20% CAGR guidance for blends; 70% vanillin exports to U.S./EU planned | Good near-term visibility from vanillin and blends; clarity lacking on full order book details |

| 2. Capacity Expansion / Capex Plans | No major capex; focus on sweating existing 6,000 TPA vanillin capacity; maintenance + debottlenecking only | Conservative and capital-efficient; but limited growth if vanillin hits peak in 2 years |

| 3. Operating Leverage | Vanillin at 45–50% utilization; breakeven expected at ~75%; profitability improves with scale | Strong potential if utilization ramps to 100% and fixed costs get absorbed |

| 4. Market Share Gains | Blends growing across geographies; no direct Indian competition in vanillin | Company is well-positioned to gain share post anti-dumping, especially vs Chinese players |

| 5. Breakout New Product / Segment / Plant | DHA & Omega-3 branded health products; potential contracts in 3–4 months; Vinpai acquisition in pipeline | Could be future growth driver; current contribution negligible |

| 6. Tone / Language Shift | Cautiously optimistic; management openly discussing price pressures but confident in growth engines | Shows realism and execution confidence; some defensiveness around vanillin pricing strategy |

| 7. External Tailwinds / One-time Gain | U.S. and EU anti-dumping on Chinese vanillin; blend inventory seasonality easing; discontinued ops write-off of ₹14 Cr | Strong pricing tailwinds, but one-time nature of tariff gains needs cautious extrapolation |

| 8. Unit Economics Improvement | Vanillin COGS to fall below $9 at 70%+ utilization; gross margin in range of 45–55% | Strong leverage likely in vanillin as utilization increases; margins should trend toward upper band |

| 9. Debt / Working Capital | Net debt improved to ₹492 Cr (from ₹564 Cr); rights issue raised equity | Moderate leverage; improving trend, but working capital strain possible if scale increases sharply |

| 10. Strategic Changes (M&A, JV, Exit) | Discontinued China/Italy plants; Vitafor integration complete; Vinpai closing by July | Clear strategic pruning and focus; new M&A can enhance Blends product depth |

| 11. Can Revenue / Profit Double in 2 Years? | Vanillin + blends can double revenues with capacity + price hikes; but price-risk remains | Yes, plausible with 100% vanillin + Vinpai synergy; but dependent on price sustenance and smooth execution |

| 12. Management Can Go Wrong / Risk Factors | Pricing pressure except vanillin; over-reliance on tariffs; delayed volume ramp-up | Risks include: tariff rollback, slow stocking clearance, weak demand pickup |

| 13. Unanswered Analyst Questions | Refused vanillin volume, regional sales data, gross margin specifics; unclear Vinpai contribution estimate | Lack of transparency on key variables reduces analyst confidence in precision modeling but this might be required to save the data from competition. |

| 14. Mind Map of MD Vision | Focus on: Vanillin ramp-up, blending expansion, margin stabilization, selective M&A, reduce discontinued ops drag | Vision is capital-light, focused on high-margin, IP-driven products; measured and patient growth model |

Risks and Management Concerns

- Vanillin Dependency: Heavy reliance on ADD-driven vanillin growth risks disruption if duties are not finalized or new competitors emerge.

- Pricing Pressure: Non-vanillin products face aggressive Chinese competition, potentially compressing margins (Page 6).

- Inventory Destocking: Slow vanillin ramp-up due to U.S. and European buyer inventories could delay revenue growth (Page 6).

- Tariff Uncertainties: Global tariff volatility could impact blends and other segments, especially in non-U.S. markets (Page 8).

- Acquisition Risks: Vinpai integration may face regulatory or operational challenges, delaying growth contributions (Page 9).

- Management’s Cautious Approach: Strategic withholding of vanillin volumes to wait for higher prices risks losing market share to Solvay or others (Page 13).

The study is based on con call transcript uploaded on BSE website.

Acquisition of Vinpai which is founded in 2011 and listed on Euronext Growth Paris since July 2023, designs and manufactures algae, plant, mineral, and fiber-based functional ingredients for the food, cosmetics, and nutraceutical industries. The company generated revenue of €9.2 million in 2024, operating from two sites in France with 43 employees. This bring a synergy in Europe a critical market for Camlin fin science.

To summaries the Camille fine sciences growth factors –

The rapid appreciation in Camlin Fine Sciences’ stock price can be attributed to a confluence of strategic corporate actions, positive financial performance, and favorable market conditions. These factors, identified through news articles and the company’s own disclosures, are detailed below:

1. Strategic Acquisition of Vinpai S.A.

One of the earliest catalysts for the stock’s upward movement in February 2025 was the announcement of Camlin Fine Sciences’ agreement to acquire a majority stake in Vinpai S.A., a France-based ingredient ‘tech company. This deal, reported on February 25, 2025, was perceived positively by the market as it signified a strategic expansion into new, high-growth areas within the specialty chemicals sector. Vinpai specializes in natural alternatives to chemical additives, aligning with global trends towards sustainable and natural ingredients. The acquisition was expected to enhance Camlin’s capabilities and product portfolio, particularly in the blends segment.

2. Successful Rights Issue

Prior to the significant price surge, Camlin Fine Sciences successfully completed a rights issue in January 2025. The rights issue, which opened on January 17, 2025, and closed on January 27, 2025, raised approximately Rs. 2,247 million. As highlighted in the company’s investor presentation, a substantial portion of these proceeds (Rs. 1,000 million) was utilized to repay Non-Convertible Debentures (NCDs) in Q4 FY25. This move significantly improved the company’s debt position, with Net Debt decreasing from Rs. 5,641 million in March 2024 to Rs. 4,918 million in March 2025, and the Net Debt-to- Equity ratio improving from 0.65x to 0.55x. A stronger balance sheet and reduced financial risk typically instill greater investor confidence and contribute to a positive stock re-rating.

3. Strong Operational Performance and Financial Results

A major driver for the sustained rally in May and June 2025 was the company’s strong operational performance and positive financial results for FY25. The investor presentation and conference call transcript revealed several encouraging aspects:

- Consistent Revenue Growth: Total Revenue for FY25 improved by 15% year-on- year to Rs. 16,665 million. The Blends business, a key segment, showed an 18% year-on-year growth, with management projecting a 20% CAGR for the next 2-3 years. This consistent growth provides strong revenue visibility.

- Improved Profitability and Operating Leverage: Adjusted EBITDA for FY25 improved by 13% year-on-year to Rs. 2,081 million, with the core business EBITDA margin at 12.5%. The management anticipates further improvement in EBITDA margins for the blends business (to high teens). Crucially, the vanillin business, currently operating at 45-50% capacity utilization, has significant operating leverage potential. As utilization increases to the targeted 100% in the next two years, the cost of production is expected to decrease substantially, leading to improved unit economics and overall profitability.

- Reduced Cash Burn from Discontinued Operations: The strategic decision to discontinue and abandon unprofitable Diphenol and Vanillin manufacturing units in Europe and China, respectively, has led to a significant reduction in cash burn. This move, along with the impairment of these assets in the September quarter, has removed a drag on the company’s financials, allowing for better allocation of resources to profitable segments.

4. Favorable External Tailwinds (Anti-Dumping Duties)

An important external factor contributing to the positive sentiment, particularly for the vanillin business, is the imposition of anti-dumping duties (ADD) on Chinese vanillin bythe U.S. and the European Union. The European Union, for instance, levied a preliminary duty of 131%. These duties are expected to lead to an increase in vanillin prices, benefiting Camlin Fine Sciences, which is a significant vanillin manufacturer. The management’s strategy to control vanillin sales in anticipation of higher future realizations (e.g., $15 vs. $12 per unit) further underscores the positive impact of these trade barriers.

5. Market Share Gains

The company’s healthy growth in the Blends business, particularly in North America, India, and Mexico, suggests ongoing market share gains in these regions. Being among the global leaders in antioxidants and a key vanillin manufacturer, Camlin is well-positioned to capitalize on these market opportunities.

Conclusion

The rapid increase in Camlin Fine Sciences’ stock price from February to June 2025 can be attributed to a combination of strategic acquisitions, a successful rights issue that strengthened its financial position, and robust operational performance driven by growth in key segments and improved profitability. The favorable external tailwinds, particularly the anti-dumping duties on vanillin, have further bolstered investor confidence. The company’s proactive management of unprofitable ventures and focus on high-potential areas have created a positive outlook, leading to a significant re-rating of its stock during this period.