How Bharti Airtel share price is beating the trend and keep breaking the 52W high?

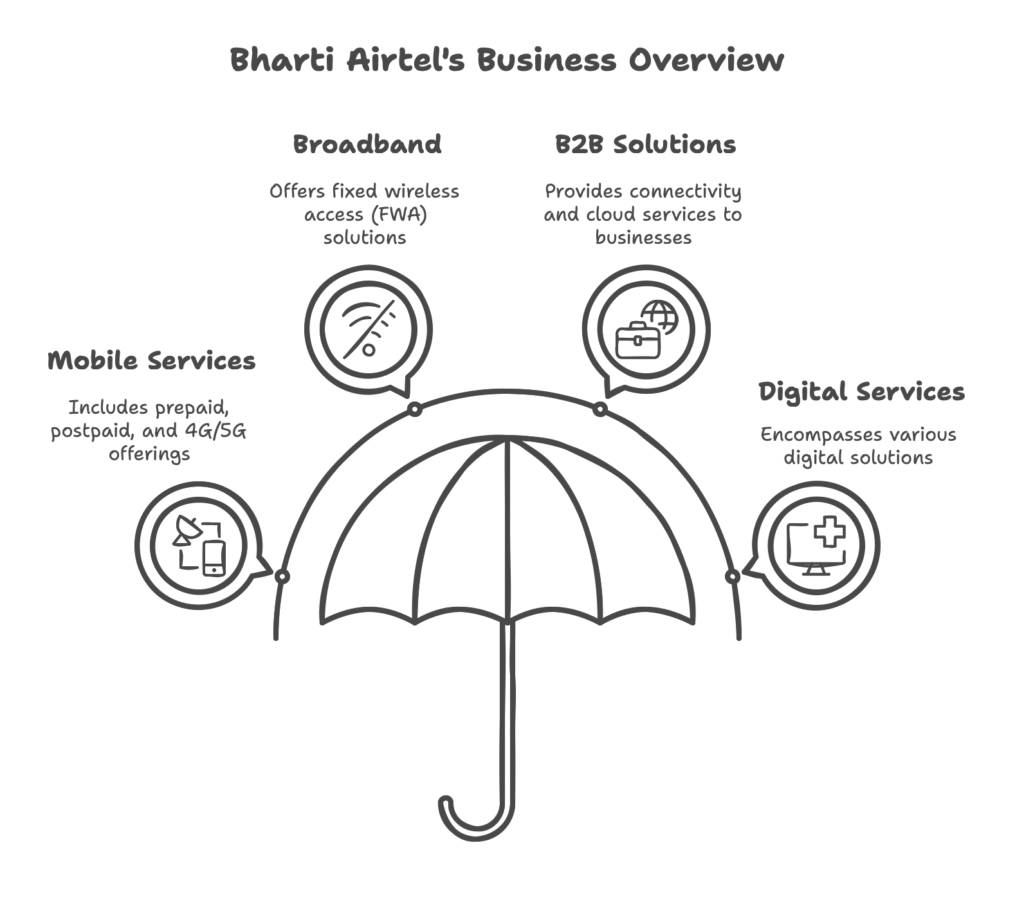

Bharti Airtel is a leading telecommunications company in India, offering mobile, broadband, digital TV, and B2B services. Bharti Hexacom, a subsidiary, operates in specific telecom circles (Rajasthan and Northeast). Product Breakup: Mobile services (prepaid, postpaid, 4G/5G), broadband (fixed wireless access – FWA), B2B solutions (connectivity, cloud services), and digital services. The business model is scalable due to high demand for connectivity, recurring revenue from subscriptions, and opportunities in adjacencies like cloud and digital solutions.

Scalability is driven by increasing smartphone penetration, 5G rollout, and B2B growth. The focus on postpaid and FWA enhances revenue stability.

Catalyst – New Product/Expansion of Bharti Airtel

Fixed Wireless Access (FWA)

Definition: FWA is a wireless broadband solution that delivers high-speed internet to homes and businesses using mobile network infrastructure (e.g., 4G/5G) instead of traditional wired connections like fiber or DSL. It uses a wireless modem or router to connect to cellular towers, offering flexibility in areas where wired infrastructure is limited.

Potential to Drive Growth:

- Market Opportunity: The transcript highlights FWA as a “big story” for Bharti Hexacom in the Northeast, driven by high education levels and social factors. This suggests strong demand in underserved or semi-urban areas where fixed broadband penetration is low.

- Scalability: FWA leverages Airtel’s existing 4G/5G network, requiring minimal additional infrastructure compared to fiber rollout. This makes it a cost-effective way to expand broadband access.

- Revenue Impact: By targeting households and small businesses in regions with limited wired connectivity, FWA can drive subscriber growth and increase ARPU (Average Revenue Per User), especially in Hexacom’s circles (Rajasthan and Northeast). The transcript notes Hexacom’s ARPU at ₹242, with potential for uplift as FWA adoption grows.

- Strategic Fit: FWA aligns with Airtel’s focus on rural and semi-urban expansion, complementing its mobile business and enhancing market share in niche regions.

Example: In Northeast India, high education levels could drive demand for reliable internet for online education, remote work, and digital services, making FWA a key growth driver for Hexacom.

B2B Cloud Adjacencies

Definition: B2B cloud adjacencies refer to Airtel’s expansion into cloud-based services for businesses, beyond traditional connectivity. The transcript emphasizes the launch of a Telco-Grade Cloud, a sovereign, regulated cloud solution built on Airtel’s private cloud expertise, designed to meet enterprise needs with high reliability and optimized costs.

Potential to Drive Growth:

- Market Growth: The transcript notes that adjacencies in the B2B market are growing at a “much faster clip,” contributing ~90% of industry growth, compared to modest growth in connectivity. This indicates a high-growth opportunity in cloud services.

- Competitive Positioning: The Telco-Grade Cloud is positioned as a differentiated offering, leveraging Airtel’s experience running one of India’s largest private clouds. It targets enterprises needing secure, scalable, and cost-effective cloud solutions, competing with global players like AWS and Azure.

- Revenue Potential: The cloud market’s rapid growth can drive higher-margin revenue streams compared to traditional telecom services. The planned market launch in June 2025, following nationwide roundtables, suggests near-term revenue contribution.

- Synergies: Combining cloud services with Airtel’s connectivity (e.g., 5G, fiber) creates a comprehensive B2B portfolio, enhancing customer retention and cross-selling opportunities.

Example: The Telco-Grade Cloud could attract enterprises in sectors like finance, healthcare, and government, where data sovereignty and reliability are critical, driving B2B revenue growth.

Summary

- FWA: Drives growth by expanding broadband access in underserved regions, leveraging existing mobile networks to boost subscribers and ARPU, particularly for Hexacom in Northeast India.

- B2B Cloud Adjacencies: Offers high-growth potential through the Telco-Grade Cloud, tapping into the fast-growing enterprise cloud market, enhancing margins, and strengthening Airtel’s B2B leadership.

Strategic Implications: Airtel and Hexacom should prioritize rapid FWA deployment in high-potential regions and aggressively market the Telco-Grade Cloud to enterprises to capitalize on these growth drivers. Investors should monitor adoption rates and revenue contributions from these segments in upcoming quarters.

Bharti Airtel Q4FY 25 key summary

| Metric | India Business | Other Countries (Africa) |

|---|---|---|

| Business Segments | – Mobile Services: Prepaid, postpaid, 4G/5G – Homes: Fixed Wireless Access (FWA), fiber broadband – Digital TV: DTH services – Airtel Business (B2B): Connectivity, Telco-Grade Cloud – Passive Infrastructure: Indus Towers | – Mobile Services: Voice, data (4G/5G), mobile money |

| Geographic Scope | – Pan-India operations – Bharti Hexacom: Rajasthan, Northeast | – 14 African countries (e.g., Nigeria, Kenya, Uganda) |

| Revenue | – ₹33,100 Crores (excl. Indus Towers) – Mobile: ~12.9% YoY growth – Bharti Hexacom: ₹2,289 Crores, 21% YoY growth, 1.7% sequential growth | – Contributes to consolidated ₹47,876.2 Crores (27% YoY growth) – Specific Africa revenue not isolated, impacted by currency devaluation (e.g., Nigerian Naira) |

| EBITDA | – ₹15,293 Crores, 53.6% margin – Hexacom: 46.6% margin, 27% YoY growth | – Not isolated, but consolidated EBITDA benefits from Africa’s rebound |

| ARPU | – Airtel: ₹245 (₹248 equal-day basis) – Hexacom: ₹242 | – Not specified for Africa |

| Operational Highlights | – 5M mobile subscriber additions – 6.6M smartphone data customers – 7.8M smartphone customer additions, 20% churn reduction – FWA traction in Northeast (Hexacom) – Telco-Grade Cloud launch planned for June 2025 | – Growth in mobile money services – 4G/5G network expansion |

| Key Growth Drivers | – Mobile subscriber growth – FWA in underserved regions – B2B cloud adjacencies (90% of industry growth) – Cost optimization (“war on waste”) | – Mobile money services – Data services demand – Network expansion |

| Challenges | – Competition from Reliance Jio, Vodafone Idea – Tariff hike dependency for ARPU growth | – Currency devaluation (e.g., Nigerian Naira) – Geopolitical risks |

| Strategic Focus | – Postpaid penetration – FWA expansion – B2B cloud (Telco-Grade Cloud) – Debt reduction (₹5,985 Crores prepaid) | – Mobile money growth – Data services expansion – Currency risk mitigation |

Bharti Airtel Q4FY25 Management Con-call summary

| Factor | Analysis | Insights/Comments |

|---|---|---|

| 1. Revenue Visibility / Order Book | Revenue for Bharti Airtel (excl. Indus) was ₹33,100 Crores, with Bharti Hexacom reporting ₹2,289 Crores (1.7% sequential growth). Strong revenue visibility due to a stable subscriber base (5 million mobile additions, 6.6 million smartphone data customers) and recurring revenue streams. ARPU for Airtel at ₹245 (₹248 on equal-day basis) and Hexacom at ₹242, indicating predictable cash flows. | High visibility due to subscription-based model and consistent customer additions. No explicit order book mentioned, as telecom is not project-based but subscription-driven. |

| 2. Capacity Expansion / Capex Plans | Capex was notably low in Q4 FY2025, with no specific completion dates provided for ongoing projects. The transcript mentions that rural rollout is complete, and future capex will be lower as the footprint is established. Focus is on optimizing existing assets rather than aggressive expansion. | Limited details on capex timelines suggest a shift to asset optimization. Investors may need clarity on future capex plans for 5G or cloud infrastructure. |

| 3. Operating Leverage | EBITDA margins improved to 50.7% for Airtel (up 1.4%) and 46.6% for Hexacom (up 30 bps). Bharti Hexacom reported 21% revenue growth and 27% EBITDA growth, reflecting strong operating leverage from cost optimization (“war on waste”) and higher ARPU. | Operating leverage is evident from margin expansion and cost control measures. Continued focus on efficiency will sustain this trend. |

| 4. Market Share Gains / Market Leadership | Airtel and Hexacom reported continued revenue market share improvements in their respective circles. Rural rollout has driven market share gains, though the pace of rollout is expected to slow. Airtel remains a market leader in India, competing with Reliance Jio and Vodafone Idea. | Strong market position, but competition in urban and rural markets remains a challenge. Hexacom’s focus on niche circles strengthens regional leadership. |

| 5. Breakout New Product/Segment/Plant | Introduction of a “Telco-Grade Cloud” as a new B2B offering, described as a sovereign, regulated cloud solution leveraging Airtel’s private cloud expertise. Roundtables have been conducted, with a market launch planned for June 2025. Focus on FWA in Northeast (Hexacom) due to high education levels and social factors. | The Telco-Grade Cloud is a promising adjacency, tapping into the fast-growing B2B segment (90% of industry growth). FWA could drive growth in underserved regions. |

| 6. Tone / Language Shift | The tone is confident and focused on operational efficiency, market share gains, and strategic growth in B2B and FWA. Emphasis on fiscal prudence, cost optimization (“war on waste”), and leveraging existing assets. No significant shift from prior quarters, but a clear pivot toward adjacencies like cloud services. | The leadership’s tone reflects optimism tempered by caution, emphasizing sustainable growth and prudent capital allocation. |

| 7. External Tailwinds / One-Time Gain | No explicit mention of external tailwinds or one-time gains. The flat ARPU (₹245) was impacted by two fewer days in the quarter, suggesting no significant one-off boosts. Industry trends like smartphone penetration and B2B growth are structural tailwinds. | Lack of one-time gains indicates results are driven by core operations, enhancing credibility of financial performance. |

| 8. Unit Economics Improvement | ARPU remained flat at ₹245 for Airtel (₹248 adjusted) and ₹242 for Hexacom, impacted by fewer days. Customer churn for Hexacom improved to 1.8% from 1.9%. Focus on postpaid and smartphone upgrades is improving unit economics by targeting higher-value customers. | Incremental ARPU growth and lower churn suggest improving unit economics, though tariff hikes may be needed for significant uplift. |

| 9. Debt / Working Capital Improvements | Airtel prepaid ₹5,985 Crores of high-cost DoT spectrum debt, indicating active debt management. No specific details on working capital improvements, but strong operating cash flow (Hexacom: ₹2,289 Crores revenue) supports financial health. | Debt reduction strengthens the balance sheet, but more details on working capital management would provide clarity. |

| 10. Strategic Changes (M&A, JV, Exit) | No specific M&A or JV announcements. Discussion on potential use of free cash flow for buybacks (Indus, Africa, or other expansions) indicates openness to strategic moves, but no firm commitments. | Fiscal prudence suggests selective M&A or investments, likely in high-growth areas like cloud or digital services. |

| 11. Can Revenue or Profit Double in 2 Years? | Doubling revenue or profit in two years seems challenging due to the mature telecom market and competition. However, growth in B2B (cloud, adjacencies), FWA, and postpaid penetration could drive significant growth. Hexacom’s 21% revenue growth and 27% EBITDA growth suggest higher potential in niche markets. Decision: Accelerate B2B and FWA offerings, explore tariff hikes, and maintain cost discipline to boost profitability. | While doubling is ambitious, 20-30% growth is plausible with new segments and operational efficiency. Tariff hikes could be a catalyst. |

| 12. Management Risks / Risk Factors | – Competition: Intense rivalry with Jio and Vodafone Idea could pressure margins. – Regulatory Risks: Changes in spectrum or telecom policies could impact costs. – Execution Risk: Failure to scale Telco-Grade Cloud or FWA could limit growth. – Capex Uncertainty: Lack of clarity on future capex could affect investor confidence. – Inflationary Costs: Rising energy and tower costs could erode margins if not offset. | Management’s focus on cost control mitigates some risks, but execution in new segments and regulatory clarity are critical. |

| 13. Analyst Questions Not Answered Clearly | The transcript mentions a question from Aliasgar Shakir (Motilal Oswal) on cash flow allocation and market stratification, which was answered broadly with a focus on fiscal prudence and growth. However, specifics on buyback targets (e.g., Indus, Africa) or detailed capex plans were not provided, indicating some ambiguity. | Management’s vague response on cash flow deployment suggests a need for clearer strategic communication. |

| 14. Mind Map of MD (Gopal Vittal) | – Core Focus: – Customer Growth: Postpaid penetration, smartphone upgrades, international roaming. – Operational Efficiency: War on waste, margin expansion. – New Segments: B2B (Telco-Grade Cloud), FWA in underserved regions. – Strategic Priorities: – Fiscal Prudence: Debt reduction, prudent cash use. – Market Leadership: Sustain share gains in competitive markets. – Challenges: – Balancing capex reduction with growth investments. – Navigating competitive and regulatory pressures. – Vision: Position Airtel as a diversified telecom and digital services leader, leveraging cloud and connectivity. | Gopal Vittal’s leadership emphasizes sustainable growth, efficiency, and diversification, with a cautious yet optimistic outlook. |