What is Bonus share and stock (share) split means for investor ?

What is Bonus share ?

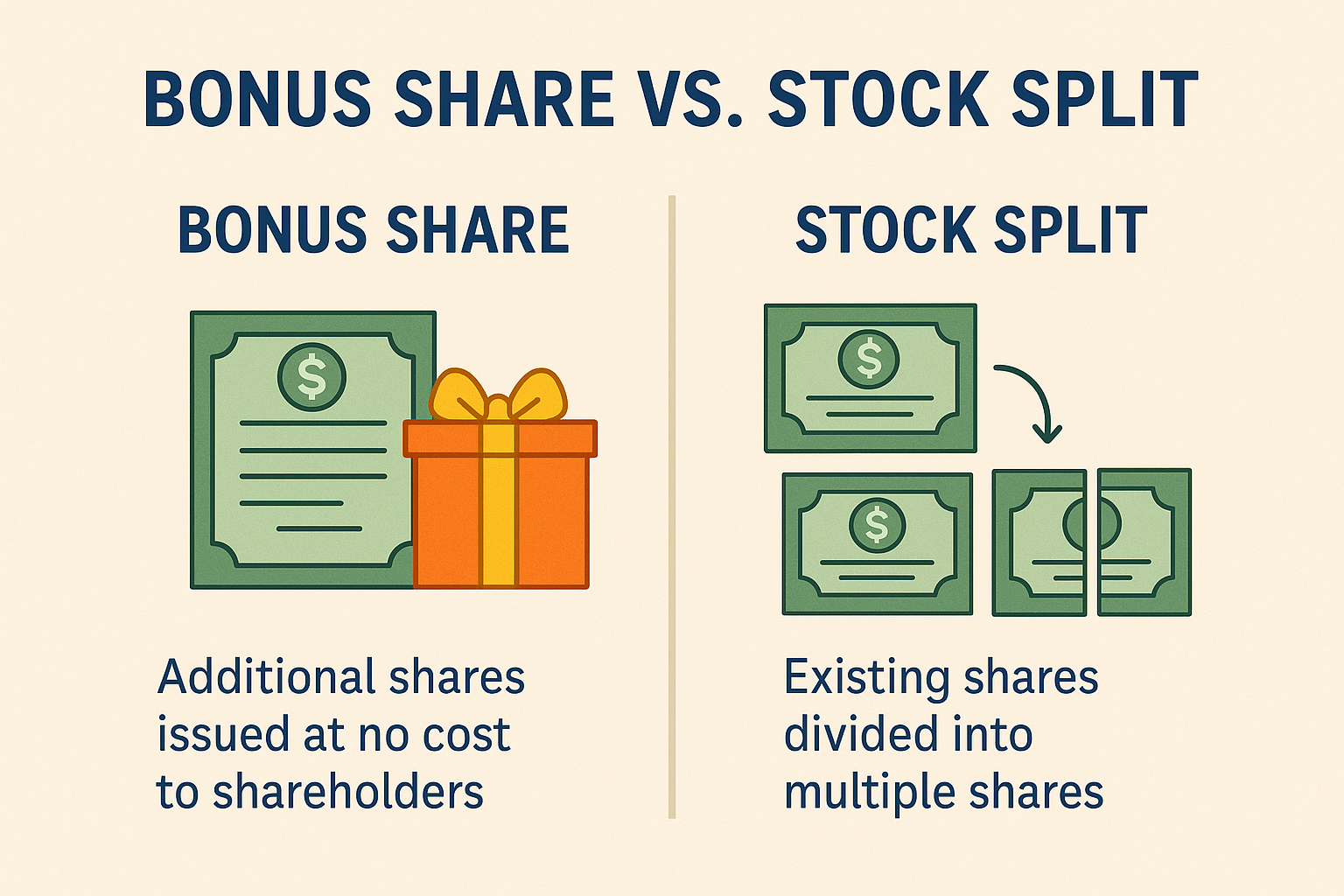

A bonus share is simple terms, an additional share given to existing shareholders at no extra cost, in proportion to their current holdings. For example, a 1:1 bonus issue means you get one extra share for every share you already own. Take Reliance industry example you have 100 share of Reliance industries so if Reliance declare bonus you will get 100 share of reliance. Yes, that does not mean your value of share will immediately double, read below.

What is the Bonus share Purpose?

Bonus is Issued to reward shareholders and capitalize a company’s reserves. It is often used as an alternative to cash dividends.

Accounting Impact:

The company transfers money from its reserves to its share capital. This increases the total share capital but does not bring in new funds to the company

Face Value:

The face value per share remains unchanged

Shareholder Value:

The number of shares increases, but the overall value of holdings remains the same as the share price adjusts downward proportionally

Tax Implications:

Bonus shares are considered received at zero cost. When sold, this can affect capital gains tax calculations

What is Stock Split (Share Split) ?

A share split divides each existing share into multiple shares, reducing the share price but keeping the total value of holdings the same. For example, a 2-for-1 split means each share splits into two, and the price per share halves. So let’s take Reliance share example, If you own 100 shares of Reliance and the company announces a 2-for-1 split, you will have 200 shares after the split, each at half the previous price.

What is the Purpose of Share split ?

Mainly done to make shares more affordable and increase liquidity by reducing the market price per share

Accounting Impact:

The face value of each share is reduced (e.g., from ₹10 to ₹5 in a 2-for-1 split), but the total share capital remains unchanged.

Face Value:

The face value per share decreases in proportion to the split

Shareholder Value:

The number of shares increases, but the total value of holdings and the company’s market capitalization remain unchanged

Tax Implications:

There is no direct tax impact; the cost of acquisition is adjusted for the new number of shares

Summary of they differences between Bonus and share split

| Areas | Bonus Share | Share Split |

|---|---|---|

| Purpose | Reward shareholders, capitalize reserves | Increase liquidity, reduce share price |

| Source of Shares | Issued from company’s reserves | Existing shares are split |

| Face Value | Remains the same | Reduced in proportion to split ratio |

| Share Capital | Increases | Remains unchanged |

| Market Capitalization | Unchanged | Unchanged |

| Tax Impact | May affect capital gains calculation | No direct tax impact |

| Example | 1:1 bonus: 100 → 200 shares | 2:1 split: 100 → 200 shares |

Let’s take a recent example Bajaj Finance 2025: Stock Split and Bonus Issue

Bajaj Finance undertook both a bonus share issue and a stock split in June 2025, making it a textbook example to understand how these two corporate actions work in practice.

Details of Bajaj Finance’s Actions

- Bonus Issue: 4:1 ratio (four bonus shares for every one share held)

- Stock Split: 1:2 ratio (each share of ₹2 face value split into two shares of ₹1 face value)

- Record Date: June 16, 2025

How It Worked for Shareholders

Suppose you held 10 shares of Bajaj Finance before the record date:

- Bonus Shares Credited

- For every 1 share, you received 4 bonus shares.

- So, 10 shares × 4 = 40 bonus shares.

- Total after bonus: 10 (original) + 40 (bonus) = 50 shares.

- Stock Split Applied

- Each of these 50 shares was split into 2.

- 50 shares × 2 = 100 shares after the split

| Step | Number of Shares |

|---|---|

| Before actions | 10 |

| After bonus issue | 50 |

| After stock split | 100 |

So if you own 10 stock of Bajaj finance before record date then you will end up having 100 share of the Bajaj finance stock post record date.

So what is record date & ex date ? in bonus and stock split terminology

Stock Split: Making a big stock value into smaller pieces.

Bonus Shares: Getting free shares.

Announcement Date: When they tell everyone about the plan.

Record Date: The day they check who owns the eligible share to give them new ones. In India settlement cycle is T+1 now so it means if today is the record date you should have stock in your account yesterday. Then you will be eligible for this.

Ex-Date: The last day you can buy the share and still get the new ones. Which means T+1 you should have sahre in your account.

.. If you buy on or after this day, you miss out on that specific split or bonus!

So what is settlement date ?

In simple terms, T+1 means that if you buy or sell a stock, the actual transfer of ownership and money happens one business day after the day you make the trade. It’s like ordering something online and getting it the next day!