Prabhakar Kudva’s techno funda setup identified Shakti pump in early days.

| Section | Theme | Prabhakar’s Perspective |

|---|---|---|

| I. Foundational Concepts | A. Importance of a Setup | Kudva insists that every investor must operate from a well-defined “setup”—a repeatable pattern with an edge. Without it, actions are random. |

| Setup Must Answer | What pattern to look for, when to buy, how much to buy, when to hold, and when/how to sell. | |

| Common Mistake | Most retail investors fail due to lack of structured setups; they hop between strategies with no process. | |

| B. Understanding Market Environment | Every setup has context—success rate fluctuates with market conditions (e.g., 80% vs. 10%). | |

| Core Insight | Always assess current environment to calibrate aggression and sizing accordingly. Neglect leads to overconfidence or missed opportunities. | |

| II. Core Setup – “Earnings Explosion” | A. Nature of Setup | Stocks rerate when there’s an earnings surprise—this is the core thesis. Market adjusts quickly to surprises. |

| Two Surprise Types | 1. Actual Earnings Surprise (e.g., PSU Banks) 2. Anticipated Earnings Surprise (e.g., Adani Group) | |

| Risk Differentiation | Anticipated earnings stories are more volatile, need different risk handling. | |

| B. Pattern Identification Checklist | 1. Financial Jump: Look for sudden spikes in revenue, operating profit, and margin. Prefer Op. Profit over Net Profit to avoid accounting noise. | |

| Margin Types | Type 1: From depressed to normalized (cyclical/value). Type 2: Extreme jumps due to tailwinds (special situations). | |

| 2. Timing | First or second quarter of improvement is key. Beyond that, upside often priced in. | |

| C. Price Action Checks | Bull Market: Big gap-up + trend continuation is bullish. Bear Market: Gap-up fades = warning sign. | |

| Volume Analysis | Look for 3–5x spike in volume with price confirmation. High volume alone is not enough. | |

| III. Execution & Risk Management | A. Improving Odds | Look for sector-wide surprise, smaller caps, recent IPOs, and low-float stocks—these amplify moves. |

| B. When to Buy | Act immediately post-results. First 30–60 minutes after open or next day max. | |

| Reason | Momentum moves quickly; delay = missed upside. | |

| C. Portfolio Allocation | Diversify with 20–30 stocks to minimize risk. Single large positions only for skilled traders in bull markets. | |

| Stop Loss Logic | For skilled: logical SL = below pre-result level. For diversified investors: No SL, as drawdowns are part of the game. | |

| D. Holding Criteria | Hold if: No new risks to earnings. Exit if: Company-specific or sector-wide threats emerge. | |

| Core Belief | Good earnings should continue; re-evaluate if thesis breaks. | |

| E. Exit Strategy | Sell if: – Result momentum fades (after 3–4 quarters) – Results look unsustainably good (mean reversion risk) – Sitting on big profits, even if no red flag yet | |

| Not Buy-and-Hold | Stocks are being temporarily rerated, not revalued forever. Must exit when story matures or stagnates. | |

| Exceptions | Outliers may run longer, but strategy shouldn’t rely on exceptions. |

Prabhakar Kudava from sitting in a small town, he made a fund of Rs 2,000 Crore and more. He also loves practices and teaches the same concept explained below.

Earning Winners | Prabhakar Kudva | Accidental Investor Prince

This summarizes key insights from Prabhakar Kudva’s discussion on his “Earnings Explosion” investment setup. Kudva, co-founder of Samiti Capital with over 20 years of market experience, outlines a systematic approach to identifying and profiting from stocks experiencing significant earnings surprises.

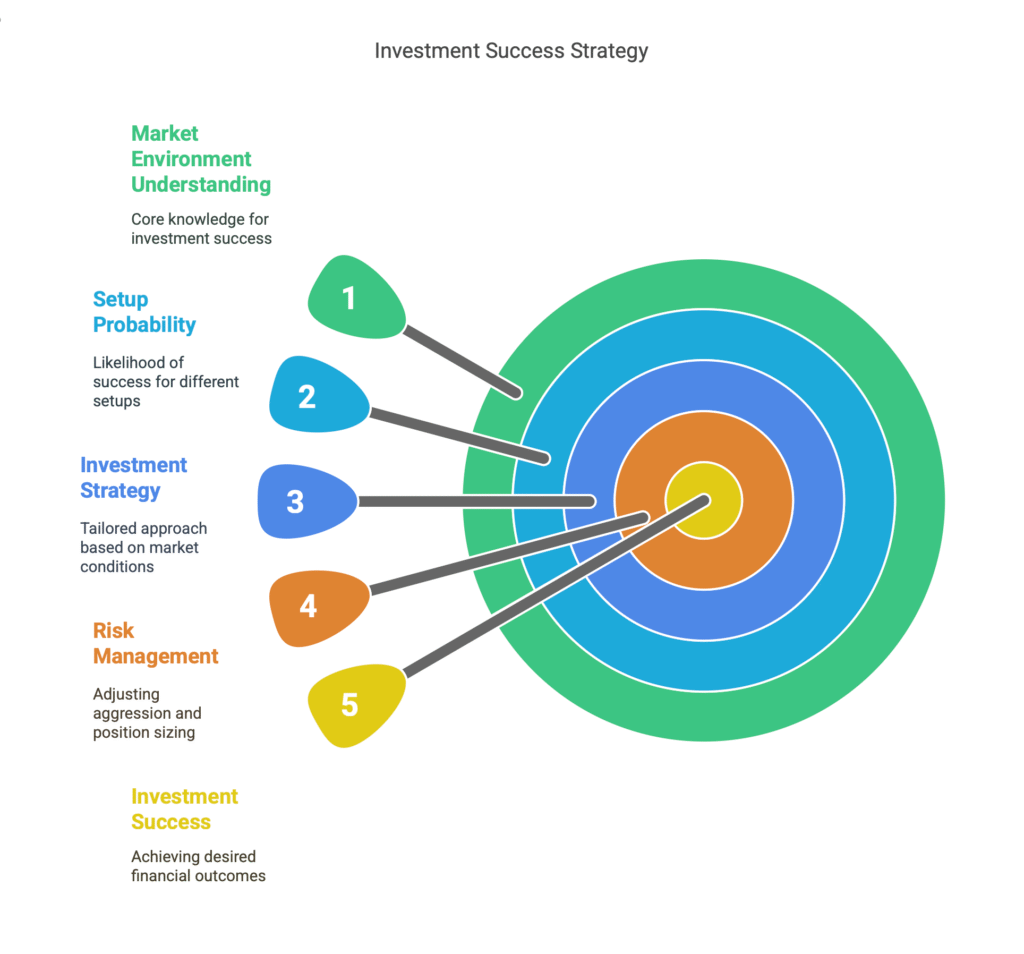

I. Foundational Concepts for Investing Success

Before diving into the “Earnings Explosion” setup, Kudva emphasizes two crucial, universally applicable ideas for any market participant:

A. The Importance of a “Setup”

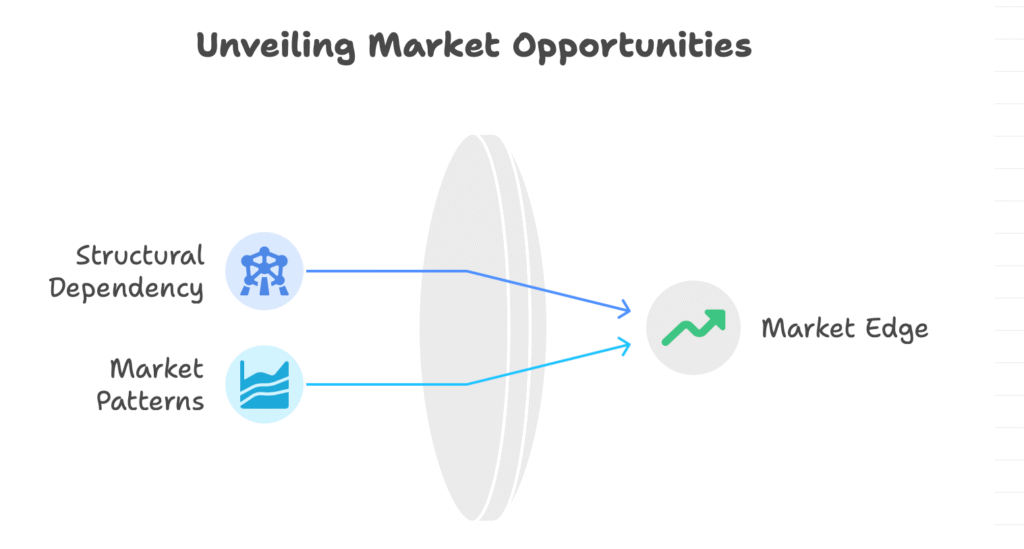

- Definition: A setup is a “pattern that is based on a structural dependency of the markets and hence that there is an edge in that.”

- Core Principle: Every investment or trading action must be based on a well-defined setup derived from a predictable market behavior.

- Essential Clarity: A robust setup requires crystal clarity on:

- What pattern to look for: Specific characteristics that signal an opportunity.

- When to buy: The precise trigger for entry.

- How much to buy (portfolio allocation): Position sizing strategy.

- When to hold: Conditions for maintaining the position.

- When and how to sell: Exit strategy.

- Benefit: Clear thought around these questions is essential to “utilize The Edge and make meaningful profits.”

- Common Pitfall: Many retail investors fail because “they don’t have a thought through setup…they are trading very randomly there is no process…and they keep jumping from one setup to another setup.”

B. Understanding the Market Environment

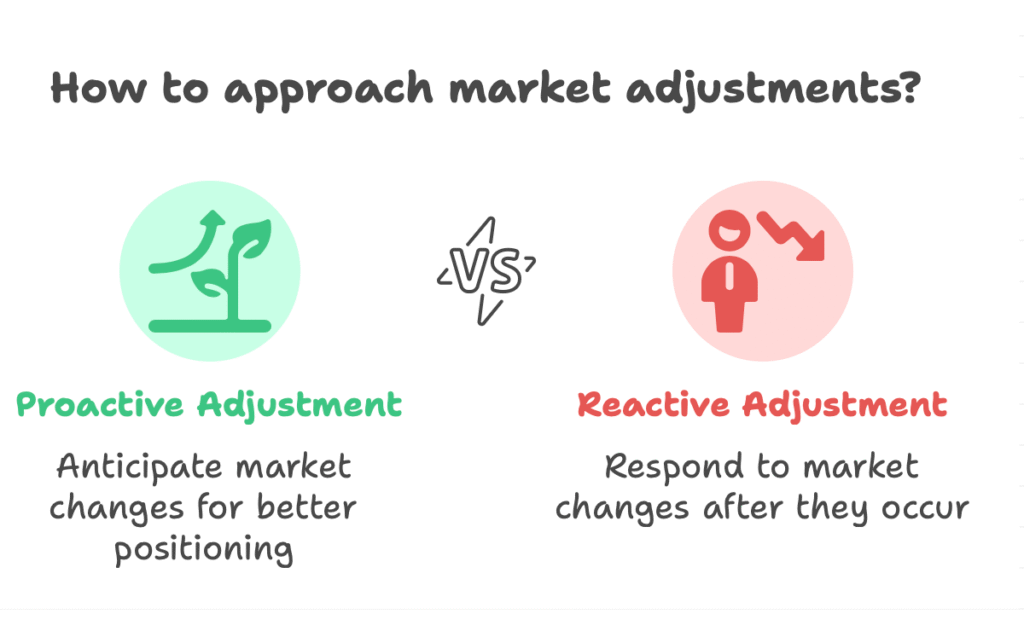

- Dynamic Success Rates: “Every setup has a different probability of success at different times in the market.”

- Impact on Strategy: A setup’s success rate can vary wildly (e.g., 80% in a conducive environment vs. 10-20% in an unfavorable one).

- Actionable Insight: Investors must have a mechanism to “understand what is the current market Environment in which we are operating.”

- Consequences of Neglect: Failing to understand the market environment leads to mistakes in aggression levels and position sizing.

- Overall Message: “You should have a sense of in what environment am I operating and you know what and and what does it mean to the probability of my success in the current environment.”

II. The “Earnings Explosion” Setup: Core Principles & Identification

This techno funda setup is based on the market’s tendency to “meaningfully adjust the valuations and the prices”. Whenever there is a surprise event. Kudva identifies two main reasons for large stock rallies:

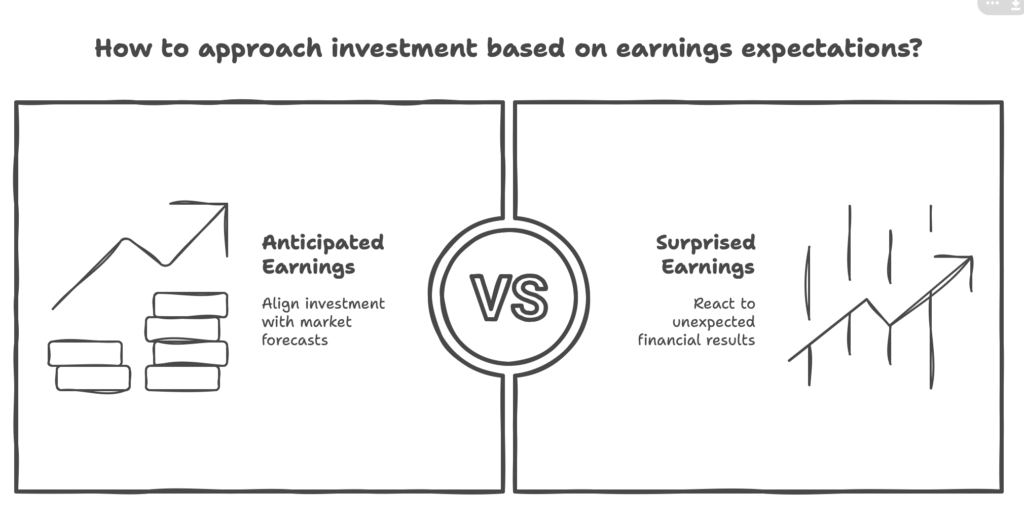

A. Two Types of Earnings Surprises

- Actual Surprise in Earnings: “An actual Improvement in…the earnings in a significant manner which forces the market to rate the stock.”

- Example: PSU Banks (Karnataka Bank, J&K Bank) reporting “Blockbuster earnings.”

- Anticipation of Earnings Surprise: “There is an anticipation that the earnings will surprise in a meaningful way.”

- Description: Often referred to as “story stocks” or “narrative-based stocks.” These stocks may outperform those with actual earnings due to psychological factors and the absence of hard data.

- Example: Adani Group rally, where stocks went up “5, 10, 15x, 20x” driven by anticipation rather than current numbers.

- Risk: Higher reward comes with “a lot of volatility and uncertainty” and requires a “different mindset and a different risk management policy.”

B. Pattern Identification: What to Look For (Checklist)

Focusing on actual earnings surprises, Kudva provides a detailed checklist:

- Big Jump in Revenues: A “meaningfully big jump in Revenue versus the last several quarters.”

- Big Jump in Operating Profit: A “big jump in operating profits for the current quarter versus the last several quarters.” This is preferred over net profit due to potential “below the line” activities.

- Expansion in Margins: This is crucial, as “Improvement in the margins gives rise to a huge operating leverage which eventually translates into a much Higher higher growth at the EPS level.”

- Type 1 (Cyclical/Value Stocks): Margins improve from depressed levels towards historical highs (e.g., 4-5% to 7%, with a historical high of 12-13%). This is common in cyclical companies.

- Type 2 (Special Situations): Margins “really shot up” significantly (e.g., 7-8% to 15-16%), often due to “Tailwinds” like crashing raw material prices or sustained pricing power. These “probably make more money.”

- Timing of the Jump: This must be the first or second quarter where such a significant jump occurs.

- Rationale: “Anything that is beyond the second quarter…that story is already still the market would have should have already rated the stock…there is nothing much left on the table for you.”

- First Quarter: By definition, a surprise quarter.

- Second Quarter: Market sometimes waits for confirmation for companies it doesn’t initially trust.

C. Price-Based Checks

- Behavior in a Bull Market:Expect the stock to “Gap up and it will never look back,” straight up “20 30 40%.”

- A gap up that fades is a “warning sign” indicating the market isn’t agreeing with the thesis.

- Behavior in a Bear Market:Expect a gap up, but “the Gap will fade and the stock will remain range bound.”

- Do not expect the stock to take off, as this is “as per the expected behavior in a bare market.”

- Volume: “Super high volume…at least…3, 4, 5x higher” on the first day is a key indicator of money flow, but “without the appropriate price action is not very meaningful.” Volume is “good to have if it is in sync with the price.”

III. Improving Odds and Execution

A. Qualifiers to Improve Probability of Success

Even if basic checks are met, certain factors enhance the probability:

- Sectoral Improvement: “Multiple companies the same sector are giving Blockbuster numbers.” This signals a real, broad-based trend (e.g., PSU Banks, IT companies).

- Smaller Company: “Choose the smaller company because smaller companies make bigger moves.”

- Recent IPO: Companies that have IPO’d in the last 2-3 years with good earnings are high-probability candidates due to “not a lot of ownership” and prior selling.

- Low Float: “If the float is low it’s very easy for the buyers to take control,” leading to “very explosive moves” when combined with good news.

B. When to Buy

- Immediacy is Key: “You have to buy immediately post results.”

- Timeline:If results are overnight: Buy “within the first 30 minutes or 1 hour.”

- If results during market hours: Buy “at least within the next day.”

- Rationale: “These stocks can very quickly move up 20 30 40% before taking a pause.”

C. Portfolio Allocation: How Much to Buy

- Diversification Recommended: “Stay Diversified with this approach” with a portfolio of “20 25 stocks” to “20 to 30 stocks.”

- Benefits of Diversification:Built-in Risk Management: Small allocation sizes mean single failures don’t significantly impact the portfolio.

- Optionality: Opens the portfolio to unexpected big winners that might not have been highly ranked initially. “Those exact stocks…end up becoming your biggest winners.”

- Concentration (for Skilled Investors Only): Possible “only during a bull market” if one is “skilled” and can implement a “proper logical stop-loss.”

- Logical Stop-Loss: “The stock should not come back to the price where it was there pre-results.” If it does, it implies the market isn’t validating the move.

- Diversified Investor’s Stop-Loss: A diversified investor “should not use any stop loss” because “diversification itself is a risk management exercise” and small/mid-cap corrections (15-20%) are normal.

D. When to Hold

- Hold as long as: “No news flow…that poses a risk to the earnings of the company.”

- Re-evaluate and Exit if:An event impacts the specific company’s earnings (e.g., raw material price increase for a chemical company).

- An event impacts the entire sector (e.g., government policy change).

- Core Thesis: The bet is that “this good quarter is going to continue.” If that thesis is jeopardized, re-evaluate.

E. When to Sell

Selling should occur in one of the following scenarios:

- Weakening Result Momentum: “The result momentum weakens considerably.”

- Fourth or Fifth Quarter of Good Results: “Generally these rallies will finish in three or four quarters.” Sitting on significant profits, it’s time to book them as “the improvement has already taken place and the improvements cannot go on forever.” “Trees don’t grow to Sky.”

- Results are “Too Good to Be True”: “If the results are so good and the margins are so high that it’s hard to significantly improve on the numbers.” This often happens in the second or third quarter (e.g., Fine Organics, Tata Elxsi). “Mean reversion is one of the…natural tendencies of the market.”

- Significant Profits (Even if Other Conditions Not Met): “If none of these are qualified but you’re sitting on significant profits…you have to take some money off the table.”

- Key Understanding: This is not a “Buy and Hold” setup. “These are candidates which are being temporarily rated…the reating in most cases will not stay forever.”

- Action: Take money off the table “especially as they become stale” (third, fourth, fifth quarter). Exceptions exist but “you cannot build a strategy around exceptions.”

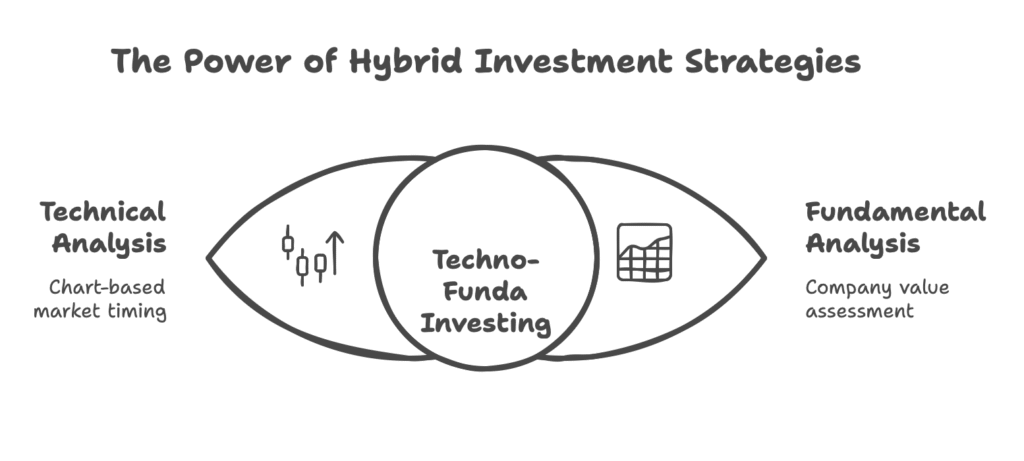

What is tehcno funda inviting strategy?

Techno-Funda Investing is a hybrid investment strategy that combines technical analysis (Techno) with fundamental analysis (Funda) to make informed trading or investment decisions. This approach leverages the strengths of both methods to identify high-probability opportunities in the stock market or other financial instruments.

Key Components of Techno-Funda Investing:

- Fundamental Analysis (Funda)

- Evaluates a company’s intrinsic value by analyzing financial statements, earnings, revenue growth, profit margins, debt levels, industry trends, and macroeconomic factors.

- Helps identify fundamentally strong stocks with long-term growth potential.

- Metrics used: P/E ratio, ROE, Debt-to-Equity, Revenue Growth, etc.

- Technical Analysis (Techno)

- Studies price movements, trends, and trading volumes using charts and indicators.

- Helps determine optimal entry and exit points based on market psychology and historical patterns.

- Tools used: Moving Averages, RSI, MACD, Support/Resistance, Candlestick Patterns, etc.

How Techno-Funda Investing Works?

Step 1: Use fundamental analysis to shortlist strong companies with good growth prospects.

Step 2: Apply technical analysis to time the entry (buying near support levels or breakouts) and exit (selling near resistance or trend reversals).

Step 3: Manage risk using stop-losses and position sizing based on technical signals.

Advantages of Techno-Funda Investing:

- Better Entry & Exit Timing – Fundamentals tell you what to buy, while technicals tell you when to buy.

- Reduces Emotional Bias – Combines objective data (fundamentals) with price action (technicals).

- Improves Risk-Reward Ratio – Avoids buying overvalued stocks or selling too early in a strong uptrend.

The above approach summaries thought of successfully fund manager who has shows proved=n track record and there is lot to learn from him. The techno funda investing or trading is one approach. You can learn more on techno funda from other blogs. One of the interesting fundamental analysis blog is Prof. Sanjay Bakshi’s approach which we find amazing and suggest to our reader as must. Here is the link.

📊 Ola Electric Q1 FY26 – Why Ola share price jumped?

Ola electric Share price sudden Jump after Q1 FY26 result – Breaking is this a…

JK paper, west coast, Emami paper stocks rallied now?

The Contrarian Case for Paper Stocks This is JK paper profits are continuously in downfall…

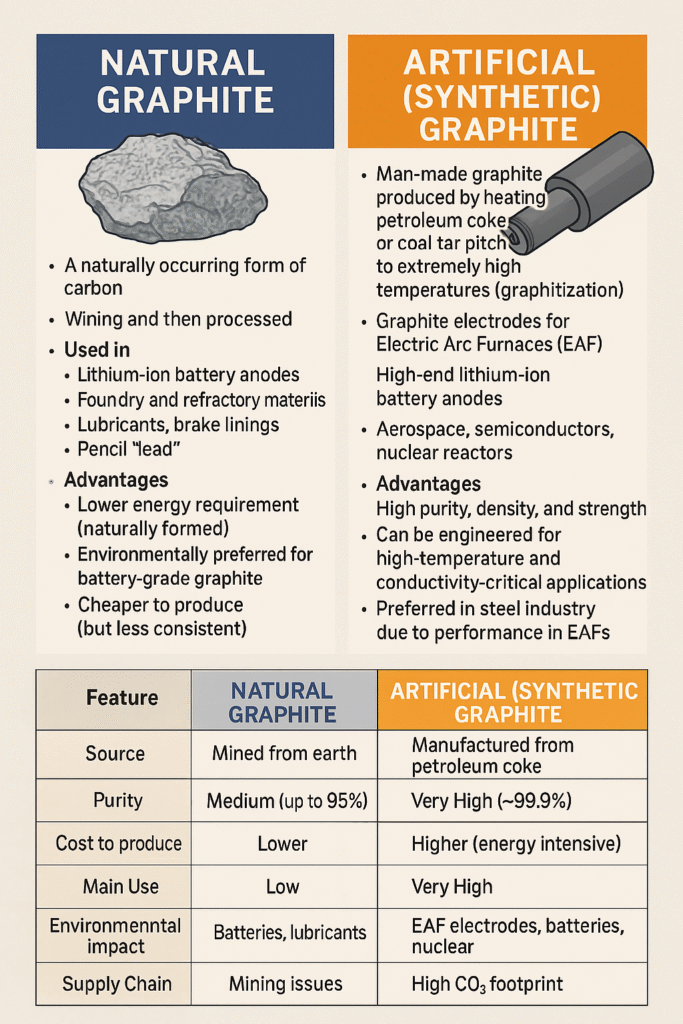

Why Is Dubai Importing So Much Natural Graphite?

Why Is Dubai a Desert City Importing So Much Natural Graphite? (2025 Analysis) Dubai has…

Impact of Anti-Dumping Duties on Methyl Acetoacetate on Laxmi Organic Industries’ PnL

Key elements impacting anti dumping duty Laxmi Organic Key Points: Laxmi Organic Industries is a…

Bajaj Finance Q4 FY25 Earnings Review: Growth, Risks & What’s Next

🔍 Bajaj Finance Q4 FY25 Analysis: Can India’s Fintech Giant Regain Its Profit Mojo? What…

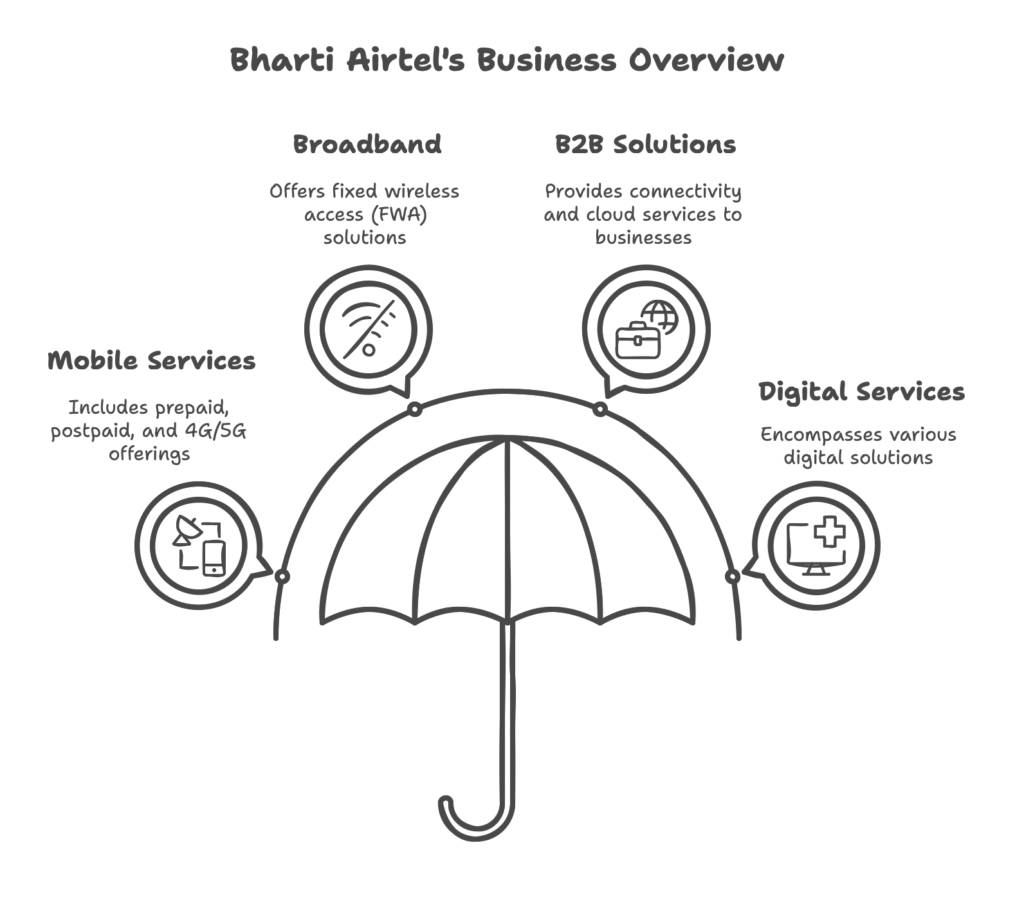

Bharti Airtel share Q4 FY25 Result – Unleashing Growth Potential

How Bharti Airtel share price is beating the trend and keep breaking the 52W high?…