“Connecting the Dots: From Panic to Prosperity”, written in a mystery-unfolding style, incorporating trending themes, historical examples like COVID, war, Adani-Hindenburg, and the psychology of traders.

Connecting the Dots: From Panic to Prosperity

The stock market, for many, is a jungle of numbers, panic, and potential. Each tick up or down is a heartbeat. For the anxious trader, every headline—pandemic, war, fraud, allegations—feels like a ticking bomb. For the curious and seasoned, it’s just another dot in a grander picture.

But here’s the thing: the market never tells you the full story upfront. It whispers. And only those who know how to connect the dots can hear the message.

Let’s decode this.

Dot #1: The Pandemic That Froze the World, Then Lit It Up

March 2020. The world halted. Streets emptied. Stocks crashed. The Nifty 50 nosedived. Fear was the only universal currency.

For most, it was the end.

But the ones connecting dots saw something else—a reset. A forced digital acceleration. A global dependence on tech, health, delivery, and clean energy.

By the time the panic traders were cutting losses, the diggers had already entered Deep Value Zone—picking Pharma, IT, API, and Digital stocks at historic discounts.

What looked like destruction was a stealth opportunity.

Paper stocks see how to connecting dots can help build perspective. Live examples click here.

Dot #2: The Russia-Ukraine War – Crisis or Catalyst?

When war broke out in early 2022, oil soared, metal prices surged, inflation skyrocketed. The talking heads screamed recession, stagflation, global uncertainty.

The headlines spooked many.

But some saw beyond.

A new energy order was forming. Those who connected the dots didn’t just survive—they thrived.

📊 Ola Electric Q1 FY26 – Why Ola share price jumped?

Ola electric Share price sudden Jump after Q1 FY26 result – Breaking is this a…

JK paper, west coast, Emami paper stocks rallied now?

The Contrarian Case for Paper Stocks This is JK paper profits are continuously in downfall…

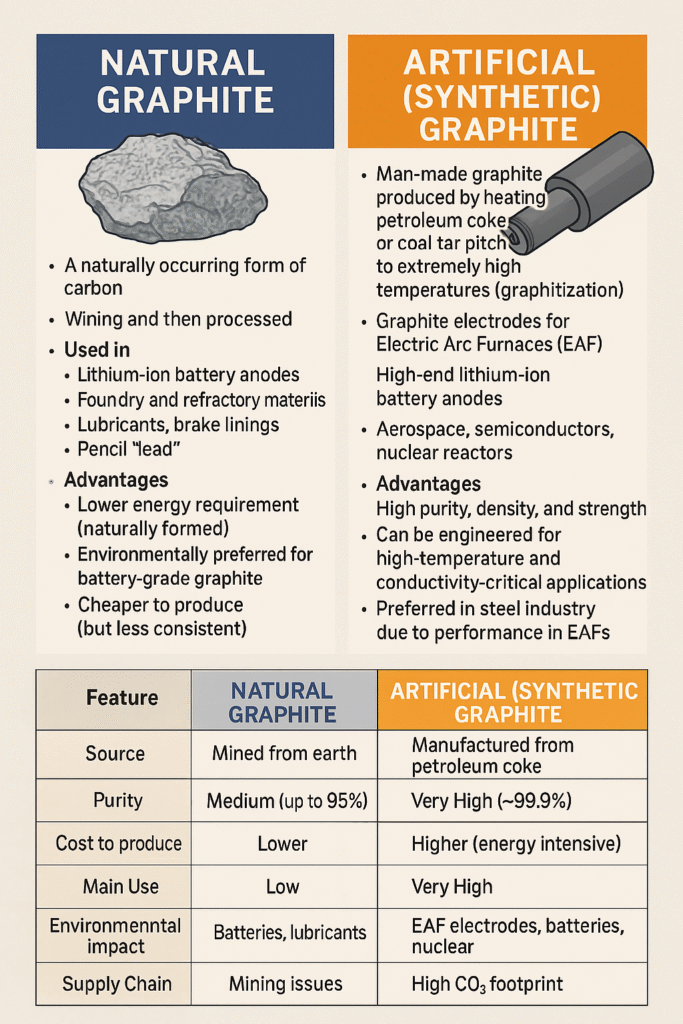

Why Is Dubai Importing So Much Natural Graphite?

Why Is Dubai a Desert City Importing So Much Natural Graphite? (2025 Analysis) Dubai has…

Impact of Anti-Dumping Duties on Methyl Acetoacetate on Laxmi Organic Industries’ PnL

Key elements impacting anti dumping duty Laxmi Organic Key Points: Laxmi Organic Industries is a…

Bajaj Finance Q4 FY25 Earnings Review: Growth, Risks & What’s Next

🔍 Bajaj Finance Q4 FY25 Analysis: Can India’s Fintech Giant Regain Its Profit Mojo? What…

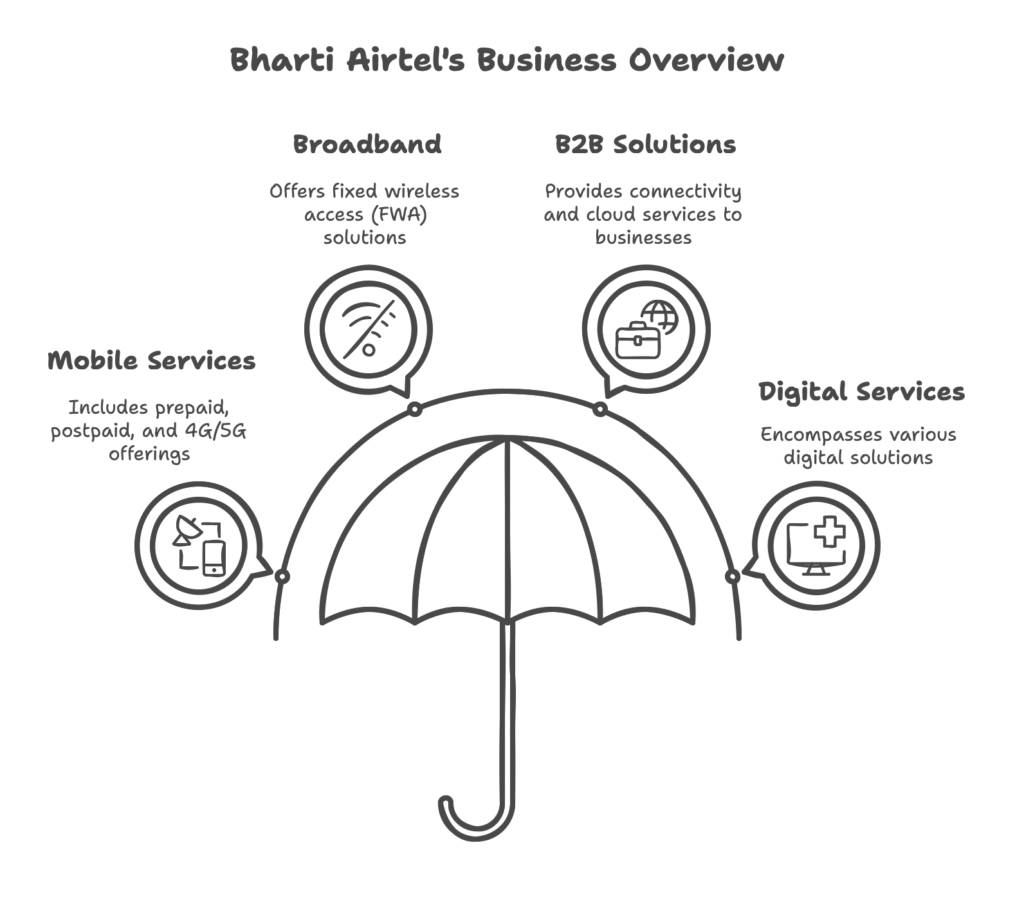

Bharti Airtel share Q4 FY25 Result – Unleashing Growth Potential

How Bharti Airtel share price is beating the trend and keep breaking the 52W high?…

Dot #3: The Hindenburg-Adani Saga – A Collapse or a Clue?

In Jan 2023, Hindenburg dropped its bombshell report on the Adani Group. Stocks freefell, wiping billions in value. Sentiment shattered.

But pause.

Zoom out.

A few savvy investors didn’t just read the report—they read between the lines. They noticed:

And slowly, the Adani stocks began crawling back. It wasn’t about right or wrong—it was about seeing resilience behind the rubble.

This wasn’t an end. It was a re-pricing of risk. And opportunity.

Dot #4: The Mind of a Fearful Trader vs. a Digger

Every day, the fearful trader wakes up to red screens, FII sell-offs, inflation prints, and Fed speak. He reacts, not responds. His portfolio becomes a mirror of breaking news, not long-term vision.

But the digger? He builds a radar.

While one trader watches social media trends, the other finds a small-cap stock in EV infrastructure that quietly bags a government contract.

That’s not luck.

That’s connecting the dots.

The Market is a Mosaic

Here’s the secret: the market doesn’t reward reaction. It rewards perception.

Every disaster, every drama—it’s a data point. And when strung together, it forms a roadmap.

Just like in Steve Jobs’ famous line: “You can’t connect the dots looking forward; you can only connect them looking backward.”

But in the markets, you must learn to see the past in the present.

Explosive Stocks Are Never Obvious

Think of the traders who believed in Tesla before 2019, IRCTC before the split, MapMyIndia before the smart mobility wave, Suzlon during its recovery. They weren’t just investors. They were detectives.

They connected macro trends, policy changes, global cues, and most importantly, human behavior.

Rory Sutherland – The opposite of a good idea can be another good idea, especially in strategic contexts where differentiation is key. While a “bad idea” is a straightforward opposite, the concept that the opposite of a good idea can also be a good idea, often referred to as a paradox, can lead to novel strategies.

So, What is the Market Today?

For the trader who lives in fear, the market is chaos. A battlefield.

But for the dot-connector, the market is a mystery novel. Every chapter brings clues. Every fall, a hidden setup.

These aren’t just headlines. They are breadcrumbs.

Final Dot: Turn Fear into Fuel

The biggest dot you’ll ever connect is this:

“Every crisis is an incubator for the next rally.”

You just need to look closer.

So, next time there’s chaos in the market—don’t panic. Pause. Observe. Decode.

Start connecting the dots.

Because the next multi-bagger, sectoral breakout, or life-changing trend may already be in front of you. Hidden. Quiet. Waiting.

Only the curious will see it.