Smart Money Moves: Crisp, Clear & Deep-Dive Financial Analysis

Welcome to oneDailysnap.com — your destination for no-nonsense, insight-rich analysis on markets, stocks, and financial trends. We strip away the jargon, focus on what truly matters, and deliver actionable intelligence in a crisp, easy-to-consume format. Whether you’re a seasoned investor or just starting out, each post brings you one step closer to making smarter, data-backed decisions with your money.

📊 Ola Electric Q1 FY26 – Why Ola share price jumped?

Ola electric Share price sudden Jump after Q1 FY26 result – Breaking is this a…

JK paper, west coast, Emami paper stocks rallied now?

The Contrarian Case for Paper Stocks This is JK paper profits are continuously in downfall…

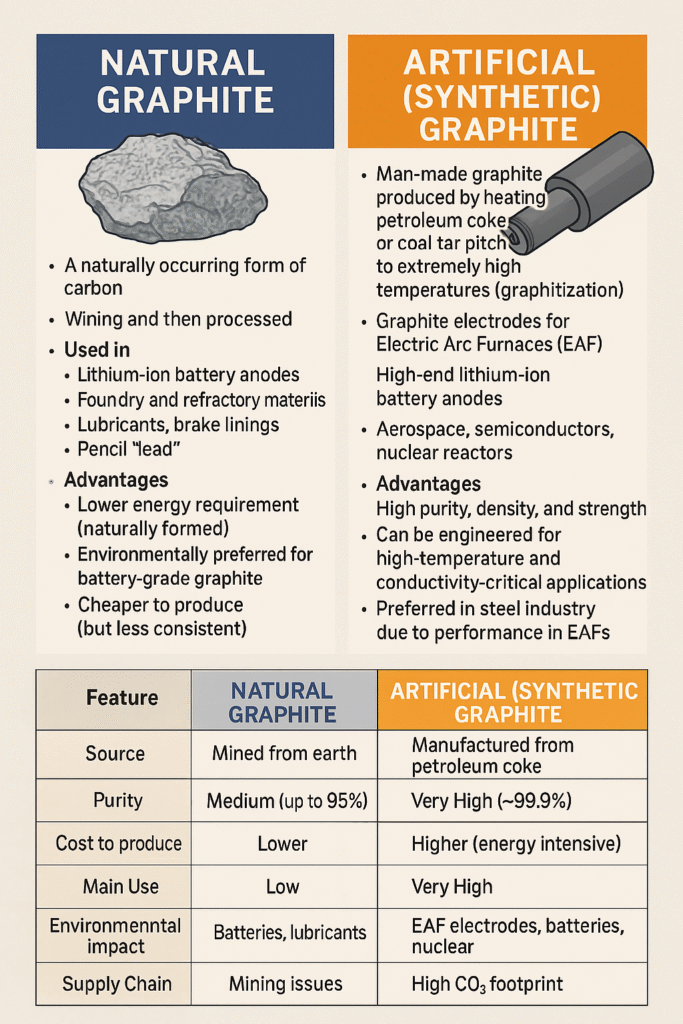

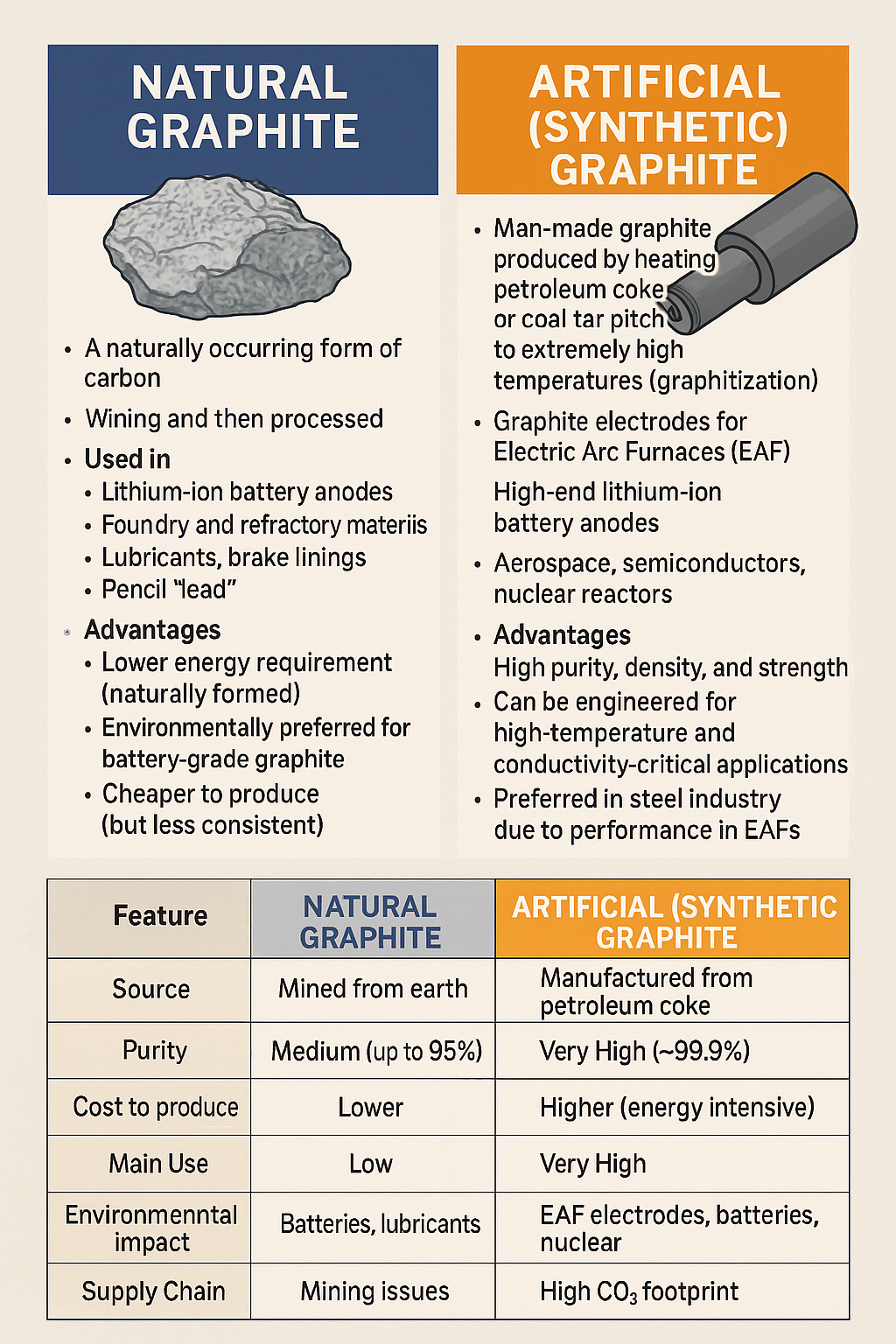

Why Is Dubai Importing So Much Natural Graphite?

Why Is Dubai a Desert City Importing So Much Natural Graphite? (2025 Analysis) Dubai has…

Impact of Anti-Dumping Duties on Methyl Acetoacetate on Laxmi Organic Industries’ PnL

Key elements impacting anti dumping duty Laxmi Organic Key Points: Laxmi Organic Industries is a…

Bajaj Finance Q4 FY25 Earnings Review: Growth, Risks & What’s Next

🔍 Bajaj Finance Q4 FY25 Analysis: Can India’s Fintech Giant Regain Its Profit Mojo? What…

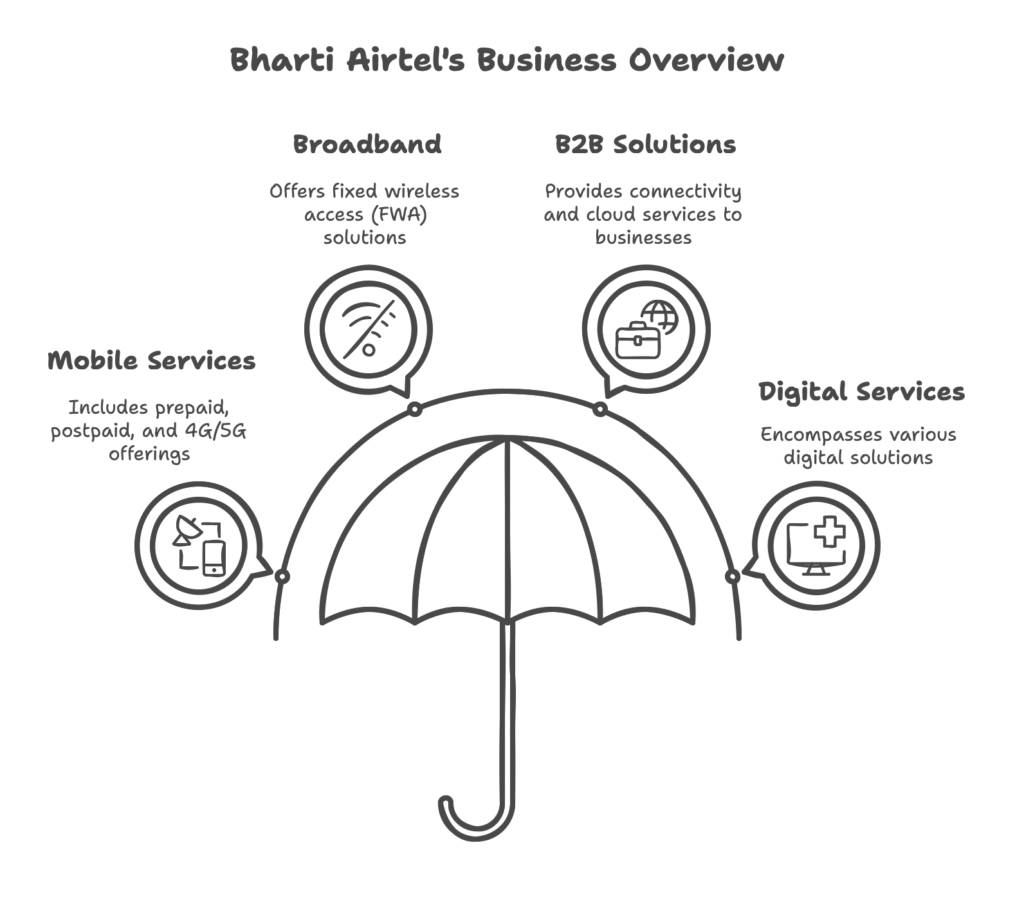

Bharti Airtel share Q4 FY25 Result – Unleashing Growth Potential

How Bharti Airtel share price is beating the trend and keep breaking the 52W high?…

Connecting the dots

Connecting the dots is our theme for finance stories

To inspire and educate traders and investors to look beyond market fear, chaos, and headlines, and develop the skill of “connecting the dots”—turning crises into opportunities by identifying hidden trends, behavioral patterns, and sectoral shifts.

Core Goals:

Create a Narrative Tool:

Position “Connecting the Dots” as a timeless lens to approach investing—making it relatable, visual, and practical.

Shift Perspective:

Reframe how people view market downturns—from panic events to data-rich opportunities.

Introduce Strategic Thinking:

Show how events like COVID, wars, frauds (e.g., Hindenburg-Adani), and global shocks are not dead ends, but entry points for smart investing.

Build Trader Psychology:

Contrast the mindset of a reactive trader vs. a proactive digger, encouraging deeper research, patience, and pattern recognition.

Decode Real-World Events:

Break down historic examples where major market fears created multi-bagger opportunities for those who stayed informed and observant.

Contrarian investing and trading:

Every crisis, headline, and panic event is a hidden dot. Learn to connect them—and what once felt like chaos turns into your greatest edge. Below three investing or trading opportunities are completely opposite but looks beyond the face value. The secret success formula if combined these three trading style can be a master blaster.

Contrarian Trading: Betting Against the Crowd — Smart or Suicidal?

Learn, backtest and then trade always

- Contrarian trading is the art of going left when the market runs right—a high-risk, high-reward strategy where traders bet against prevailing sentiment

- It’s not just about disagreeing with the crowd…

It’s about spotting irrational exuberance or fear-driven sell-offs, and profiting from mispriced emotions - You look and and don’t reach but respond to situation with well calculated risk management strategy

Value investing – Warren Buffet and renowned investors strategy

Find neglected opportunities which other don’t care

- Value investing, as practiced by Warren Buffett and Charlie Munger, is far more than just buying cheap stocks—it’s a philosophy rooted in patience, discipline, and deep understanding of businesses.

- Buying a good business at a price less than its intrinsic value—and then being patient enough to hold it long-term as the value is realized.

- E.g. Apple: Though initially tech-averse, Buffett later saw it as a consumer product company with a sticky ecosystem and invested in Covid times .

Momentum trading is the opposite of value investing in many ways

Stocks that are going up will keep going up, and those going down will keep going down—at least for a while.”

- Momentum trading is based on the idea that strong trends persist—due to market psychology, institutional flows, and herd behavior.

- Buy high, sell higher

- Sell low, buy lower

- This seems counterintuitive to value investing, but it works in the short to medium term for many active traders.

- Volume Confirms Price

Strong momentum = Price ↑ + Volume ↑

It shows big players are involved.