The Contrarian Case for Paper Stocks

This is JK paper profits are continuously in downfall nothing seems exciting as of date 5 Jul 2025

It might seem counterintuitive at first—why would anyone bet on paper stocks when profits are down, realizations are weak, and import pressures continue to hammer margins?

But if we look deeper, beyond the short-term noise of earnings disappointments, a contrarian opportunity may be quietly unfolding in the Indian paper sector.

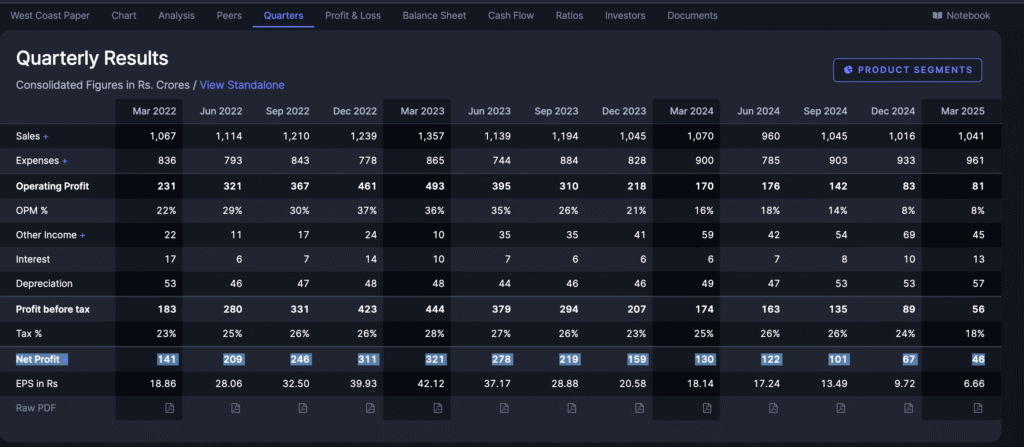

West Coast paper performance shows the profits are eroding faster then ever.

Why Paper stocks rallied on friday? while overall market was under pressure.

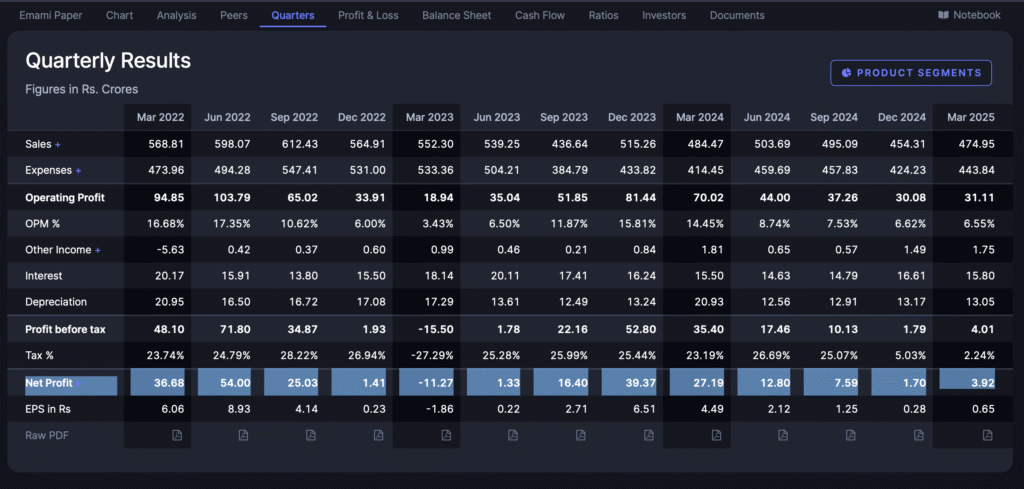

What the Numbers Say: Pain is Real

Let’s not sugarcoat it:

- Q4 FY25 results for most major players like JK Paper, West Coast, Emami paper and Andhra Paper have been soft.

- EBITDA margins are shrinking, mainly due to a spike in wood and fuel costs.

- Cheap imports from ASEAN countries (Indonesia, China) are flooding the Indian market, compressing pricing power.

- Even profit after tax (PAT) has taken a hit across the board, with year-on-year declines despite steady volumes.

But here’s the twist—bad numbers often precede inflection points.

Why the Tide May Be Turning?

Anti-Dumping Duties Are Coming

The Indian government is evaluating anti-dumping duties on paper pulp board imports from China, Indonesia and other countries. If implemented, this could restore pricing power for domestic players and restrict undercutting by foreign suppliers. DGTR announced it will start investigation on 3rd Jul 2025 and this was big sign of relief for Indian paper stock companies.

Think of this as a vaccine against margin erosion.

Valuations Are Dirt Cheap

Let’s face it—paper stocks are trading at depressed valuations:

- P/E ratios in single digits or max under 20’s

- EV/EBITDA multiples at multi-year lows

- Dividend yields of 4–5% in many cases

This is a textbook setup where bad news is already priced in, and any positive surprise (anti-dumping, demand rebound, input cost correction) could trigger a sharp re-rating.

Who is largest Paperboards & Packaging material produce in India?

ITC is the India leading paper producing company and its paper division is down by 34% this year

| Segment | FY25 Revenue YoY | FY25 PBIT YoY | Performance overview |

|---|---|---|---|

| FMCG – Cigarettes | ₹32,631 Cr (+7%) | ₹20,025 Cr (+5%) | Premium segment strong. |

| FMCG – Others | ₹21,982 Cr (+5%) | ₹1,580 Cr (↓11%) | Atta, Spices, Personal Wash strong. |

| Agri Business | ₹19,754 Cr (+25%) | ₹1,478 Cr (+18%) | Leaf tobacco, rice, spices, coffee strong. |

| Paper & Packaging | ₹8,423 Cr (+1%) | ₹911 Cr (↓34%) | Hurt by low Chinese imports, wood prices; Décor paper exports aided. |

| ITC Infotech | ₹4,245 Cr (+14%) | ₹787 Cr (+13%) | IT arm shows healthy growth. |

Mean Reversion Is Due

Historically, paper stocks move in cycles—multi-quarter slumps are followed by swift upcycles. Right now, we’re at the tail end of a downcycle:

- Inventories have normalized

- Input costs may have peaked

- Demand (esp. in education & publishing) is stabilizing

Emami paper stock hitting lowest profits ever.

What to Watch Next in paper stocks?

Keep an eye on these potential triggers:

- Official notification of anti-dumping duty submission to finance ministry. Once approved these stocks will start showing the effect in there quarterly earning. Keep eyes on these you will not miss the rally.

- Fall in global pulp and wood prices

- Improvement in EBITDA margins in next 2 quarters

- Progress in packaging segment consolidation and scale-up

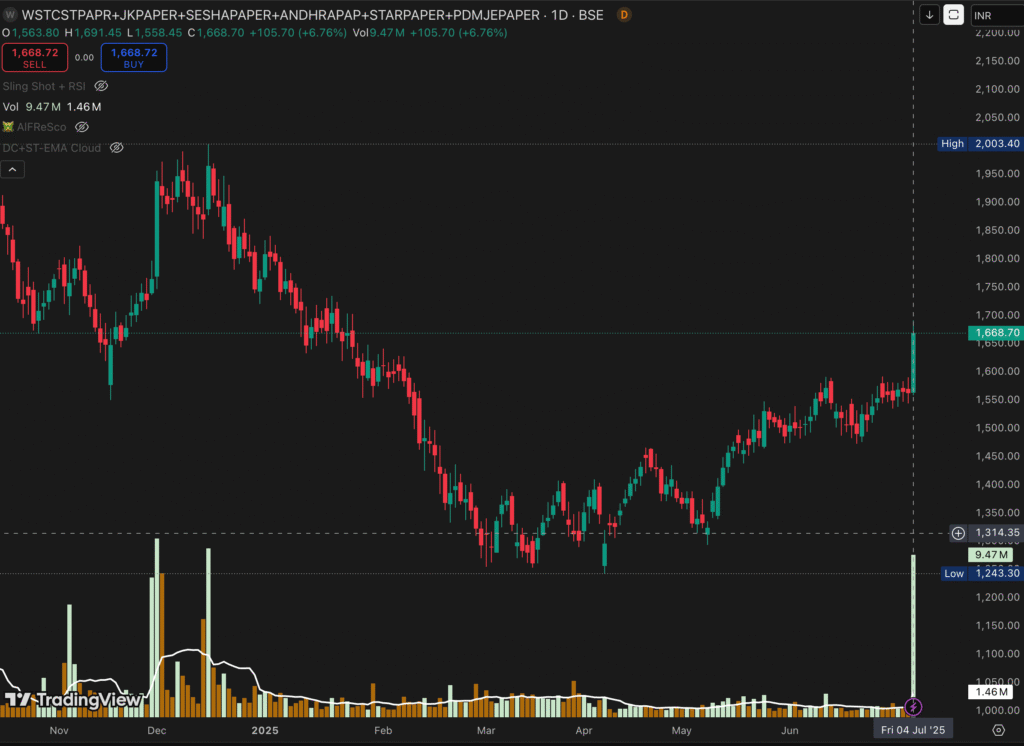

Why you should watch? Its the industry tail wind about to start

On 4th Jul 2025, the overall paper sector shown the sign of bottoming out by its price action. There is no formal paper index so we have clubbed the major paper stocks in trading view. This gives us idea of huge volume poured and price rose.

So according to Prof. Sanjay Bakshi he bet on value investing where he gets a good deal and from those stock which are negated by market. So this fits in all perspective fundamental, technical investors and finally price started speaking about.

Remember this is cyclical industry which means it can take year to recover if you are stuck at upper level. So do you analysis and see how it fits in your perspective.

10 Top Indian Paper Companies by Production Capacity / Volume

| Rank | Company Name | Approx. Installed Capacity | Key Products | Exchange | Ticker |

|---|---|---|---|---|---|

| 1 | JK Paper Ltd | ~6.25 lakh TPA (post-M&A) | Writing & Printing, Packaging Board | NSE, BSE | JKPAPER |

| 2 | West Coast Paper Mills | ~4.9 lakh TPA | Copier, Writing & Printing | NSE, BSE | WSTCSTPAPR |

| 3 | Tamil Nadu Newsprint (TNPL) | ~4.6 lakh TPA | Printing, Packaging, Newsprint | NSE, BSE | TNPL |

| 4 | Century Pulp & Paper (part of Century Textiles) | ~4.5 lakh TPA | Tissue, Board, Paper | BSE | CENTURYTEX |

| 5 | Emami Paper Mills | ~3.5 lakh TPA | Newsprint, Coated Paper | NSE, BSE | EMAMIPAP |

| 6 | Andhra Paper Ltd | ~2.5 lakh TPA | Writing, Printing | NSE, BSE | ANDHRAPAP |

| 7 | Orient Paper & Industries | ~1 lakh TPA | Writing & Printing | NSE, BSE | ORIENTPPR |

| 8 | Seshasayee Paper | ~1.3 lakh TPA | Printing, Writing | BSE | SESHAPAPER |

| 9 | Star Paper Mills | ~1 lakh TPA | Industrial Grade | BSE | STARPAPER |

| 10 | NR Agarwal Industries | ~1.4 lakh TPA | Duplex Board, Kraft | BSE | NRAIL |

ITC is also leading player but this has other segments also so excluded from this list.