The Opposite of a Good Idea is also a good idea – A Discussion on Concentration, Serendipity, and Investing

Source: Excerpts from “The Opposite of a Good Idea | Prof Sanjay Bakshi 1 Nov 2020”

Speakers: Prof. Sanjay Bakshi (Management Development Institute, Gurgaon) and Neeraj Murarka (Pune-based investor). Mr Bakshi is very famous and renowned in value investing field and he actively practices Chariel Munger and Warrant Buffets teachings. His behavior economics combined with spiritual learning makes a hug difference they way he teach vs any other prof. We respect highly and hence thought of capturing his discussion and connect with real worlds example.

I. Core Thesis: The Counter-Intuitive Nature of “Good Ideas” in Social Sciences and Investing

The central theme of this discussion, encapsulated in its title, is that “the opposite of a good idea can also be a good idea,” particularly in the realms of social science, human behavior, and investing. This stands in contrast to fields like physics, where universal laws apply. The speakers argue that context, human psychology, and an element of luck or serendipity play a far greater role than often acknowledged, challenging conventional wisdom and emphasizing the importance of diverse approaches and open-mindedness.

II. The Power of Focus and Deep Work: A Foundation for Success (and recognizing “bad” ideas)

Before delving into the “opposite of a good idea,” the discussion first establishes the importance of focused effort and deep work. This foundational concept is illustrated through:

- The Story of Arjuna: The ancient Indian epic’s tale highlights Arjuna’s unparalleled concentration, seeing “nothing but the black eye in the center of the bird’s eye,” while others were distracted by the tree, branches, sky, and sun. This serves as a powerful metaphor for single-minded focus.

- Swami Vivekananda’s Admonition: “Take up one idea. Make that one idea your life – think of it, dream of it, live on that idea… and just leave every other idea alone.” This quote reinforces the transformative power of singular focus.

- Swami Sarvapriyananda’s “Secret of Concentration”: The speaker highly recommends this lecture, linking concentration to the concept of “flow” states and the yogic principles of Patanjali:

- Pratyahara: Withdrawal of the senses from external objects.

- Dharana: Concentration; focusing the mind on a particular topic.

- Dhyana: Contemplation/Meditation; non-judgmental awareness of the focused object.

- Samadhi: Deep contemplation, leading to absorption in the object.

- Cal Newport’s “Deep Work”: This book is cited to emphasize that “high-quality work produced = time spent x intensity of focus.” Deep work requires sustained, distraction-free concentration on a single task.

- “Solitude and Leadership” by William Deresiewicz: The essay warns that “multitasking… impedes your ability to think. Thinking means concentrating on one thing long enough to develop an idea about it.” This underscores the detrimental effect of constant distraction on genuine thought.

- Fighting Technology: The digital age, with its constant notifications and social media, “destroys our attention completely.” The speakers advocate for intentional strategies to minimize distractions, such as putting phones away, turning off notifications, and utilizing tools that promote focus. “You have to fight technology with technology.”

III. The Role of Serendipity, Luck, and Non-Linearity

A significant portion of the discussion is dedicated to the idea that success, discovery, and even investing outcomes are not solely products of linear, logical effort.

- “The Lucky Are Those Who Are Always Looking”: Rory Sutherland’s quote emphasizes that opportunities arise from continuous observation and openness, not just targeted searching.

- Accidental Discoveries: Numerous scientific breakthroughs are highlighted as products of serendipity rather than intentional pursuit:

- Penicillin: Alexander Fleming’s accidental discovery due to a contaminated petri dish.

- Mustard Gas: Discovered as a side effect while searching for a treatment for tuberculosis.

- Coca-Cola: Originally intended as a painkiller.

- Viagra: Discovered as a side effect of a drug for heart problems.

- LSD: Albert Hofmann’s accidental self-experimentation.

- “The Adjacent Possible”: Steven Johnson’s concept describes how innovation often occurs by combining existing elements in novel ways, highlighting the non-linear path of discovery.

- Amazon’s Approach to Failure: Jeff Bezos is quoted on Amazon’s philosophy: “Failure is not optional. We invent, failure and invention are inseparable twins… Most large organizations embrace the idea of invention but are not willing to suffer a string of failed experiments necessary to generate big outsized returns.” This demonstrates a deliberate embrace of experimentation and the inevitable failures that come with it, recognizing that “luck” can stem from a high volume of trials.

- Music Lab Experiment (Matthew Salganik): This experiment starkly illustrates the power of social influence and “luck” in determining popularity. In parallel virtual worlds, seemingly identical songs achieved vastly different levels of popularity, demonstrating that initial random success could snowball, leading to different “winners” even with the same underlying quality. “The songs that became hits in one world also failed to become the most downloaded song in the other world.” This highlights the “luck of being in the right place at the right time.”

IV. “The Opposite of a Good Idea” in Social Sciences and Business

Rory Sutherland’s insights are central to this part of the discussion, emphasizing that what seems illogical can be highly effective in human systems.

- Logic vs. Human Behavior: “Logic requires universally applicable laws, but outside scientific truth, we find that human behaviour cannot be modelled in one way.” What works in one context may fail in another.

- “Good Ideas Can Also Be Bad Ideas”: The example of Scarcity Marketing and Ferrari is presented as a prime illustration. While conventional business logic suggests maximizing sales, Ferrari intentionally limits production to create exclusivity and desire. This “deprivation marketing” fuels demand and allows them to charge premium prices. “Ferrari is arguably the greatest value creator for its shareholders, and it practices what Rory Sutherland calls deprivation marketing.” This strategy, which would be considered “bad” in most industries, is immensely successful for Ferrari due to its understanding of human psychology and the luxury market.

- Context is King: The speakers emphasize that “context is far more important than people think.” Universal models often fail to account for the nuances of human behavior.

- The “Secret Sauce” of Success: The core idea is that “human behaviour is illogical. You cannot predict it with any kind of mathematical formula. You cannot predict it with any kind of logic.” This implies that understanding human psychology, even its irrationalities, is key to success in social sciences and business.

V. Investing: Embracing Diversity and Context

The principles of “the opposite of a good idea” are directly applied to investing, advocating for an open-minded and adaptable approach rather than rigid adherence to a single philosophy.

- Challenging Investment Dogma: The speakers argue that “the opposite of a good idea can also be a good idea” in investing. There are “several schools of thought… and all of them can work for a period of time.”

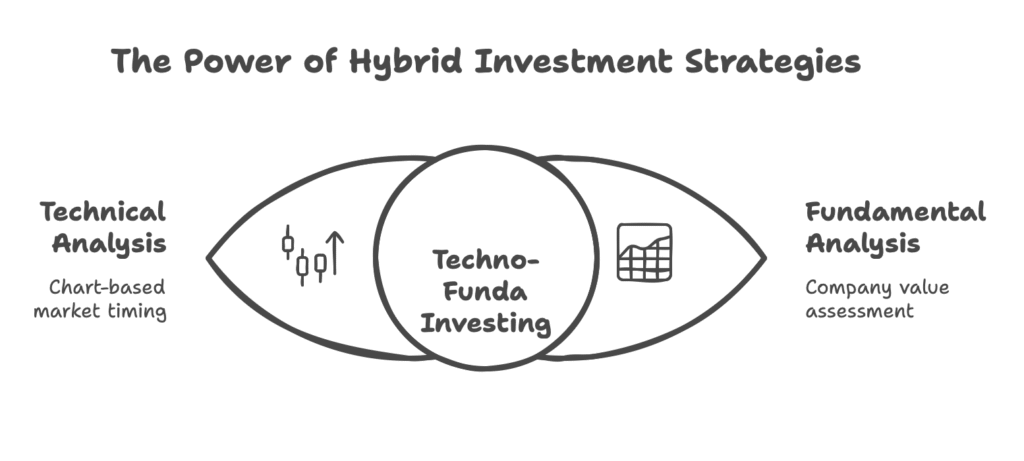

- Six Pairs of Investment Ideologies: Prof. Bakshi presents six contrasting pairs of investment approaches, asserting that both sides of each pair can be successful, depending on the context and market conditions:

- Highly Liquid Portfolio vs. Portfolio for Growth: (e.g., gold vs. growth stocks)

- Fundamental Momentum vs. Technical Momentum: (Faith in computations vs. love for technical charts)

- Low-Cost Producers in Quality Businesses vs. High-Cost Producers (Betting on Commodity Price Rise): (Competitive advantage vs. commodity cycle plays)

- Deep Value vs. High-Quality/High-Growth: (Lowest valuation vs. highest considered stocks)

- Multi-Baggers (Small Cap) vs. Several Small Steps (Large Cap/Diversification): (Exploiting growth vs. exploiting miscorrelation)

- Graham-Style Value Investing vs. Crisis Investing: (Classic value vs. capitalizing on distress)

- No Single “Right” Way: The overarching message is that “there is no single right way” to invest. “The environment is changing, you’re changing, so there’s no single recipe.”

- The “Bell Curve of Returns”: Returns in investing are not evenly distributed. A significant portion of returns often comes from a few outlier investments, making diversification and exposure to various possibilities crucial. “You don’t know what is going to work. So expose yourself to multiple opportunities.”

- Humility and Adaptability: Investors need to be humble and recognize that what worked in the past may not work in the future. “Always be willing to accept that what you are doing is not yielding the best results, and there’s another approach, another approach, another approach.”

- The Importance of “Knowing What You Don’t Know”: Investors should be aware of their biases and limitations. Overconfidence can be detrimental. “The most important thing for an investor is to know what they don’t know.”

- The Illusion of Control: In social systems and markets, “you have zero control.” This reinforces the need for an adaptable and open-minded approach that embraces unpredictability.

VI. Conclusion: Embracing Contradiction and Continuous Learning

The discussion concludes by reinforcing the idea that fixed, logical models often fail when dealing with human behavior and complex systems like markets. Success often lies in:

- Understanding Human Psychology: Recognizing that humans are not always rational and that seemingly “bad” ideas can work based on psychological principles (e.g., scarcity).

- Openness to Serendipity: Creating an environment that allows for accidental discoveries and capitalizing on unexpected opportunities.

- Diversity of Approach in Investing: Not being wedded to a single ideology but understanding that different strategies can yield results in different contexts.

- Continuous Learning and Introspection: Regularly evaluating one’s approaches, being willing to change, and admitting mistakes. “It’s always important to regularize that this school has worked for a long time but for the last 10 years, it has also not worked.”

- Fighting Distraction: While embracing broad ideas, the importance of deep, focused work remains paramount for effective execution and identifying genuine opportunities amidst noise.

Pingback: From Crude Prices to IT Stocks: The Ripple Effect of Iran-Israel Conflict on India - onedailysnap.com

Pingback: Earning explosion setup - techno funda investing by Prabhakar Kudva - onedailysnap.com